June Sees Significant Yearly Increase in Building Material Prices

Originally Published by: NAHB — July 12, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

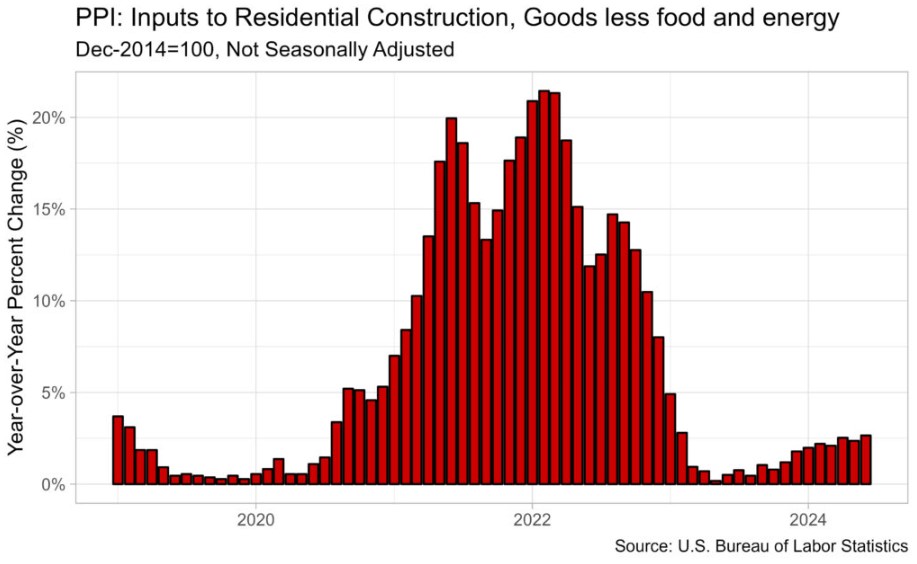

Inputs to residential construction, goods less food and energy, rose 0.19% in the month of June according to the most recent producer price index (PPI) report published by the U.S. Bureau of Labor Statistics. The index for inputs to residential construction, goods less food and energy, represents building materials used in residential construction. In May, the index fell 0.26% after rising in April 0.22%. Over the year, the index was up 2.65% in June. Year-over-year growth has continued to climb this year, June’s increase was the highest since February of 2023. Despite overall inflation declining, prices for inputs to residential construction have accelerated since the start of the year, leaving home builders to continue to deal with higher building material prices.

The seasonally adjusted PPI for final demand goods decreased 0.55% in June, after falling a revised 0.77% in May. The PPI for final demand energy and final demand foods both fell by 2.64% and 0.33% respectively. Final demand energy fell for the second straight month after falling 4.61% in May. At the same time, the PPI for final demand goods, less food and energy, rose a marginal 0.02%. Over the year, the index for final demand goods, less food and energy, was up 1.81%.

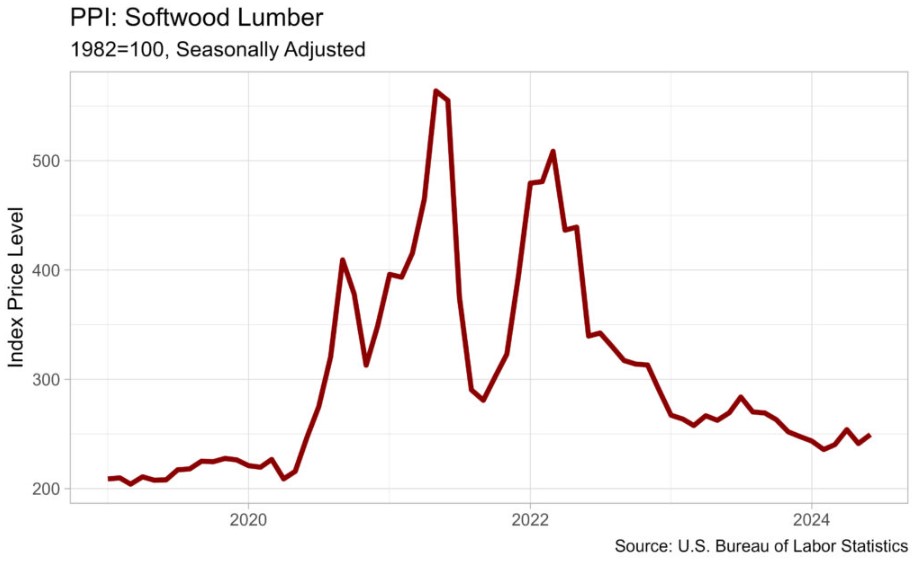

The seasonally adjusted PPI for softwood lumber rose 3.41% in June, after falling 5.00% in May. Prices for softwood lumber are 7.41% lower than June 2023. Lumber prices remain lower than the peaks and valleys of 2020 through 2022 but remain higher than 2019 according to the index.

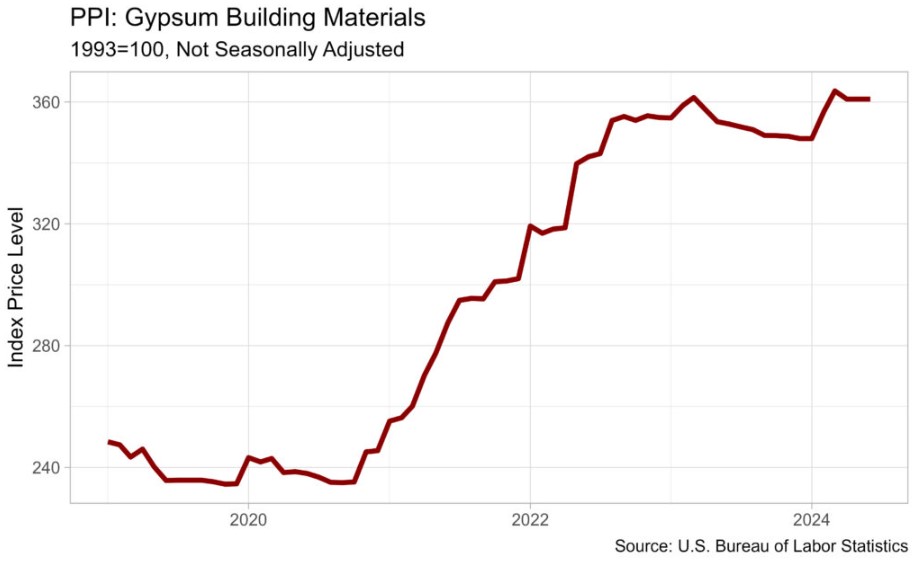

The non-seasonally adjusted PPI for gypsum building materials was unchanged for the second consecutive month but was up 2.32% over the year.

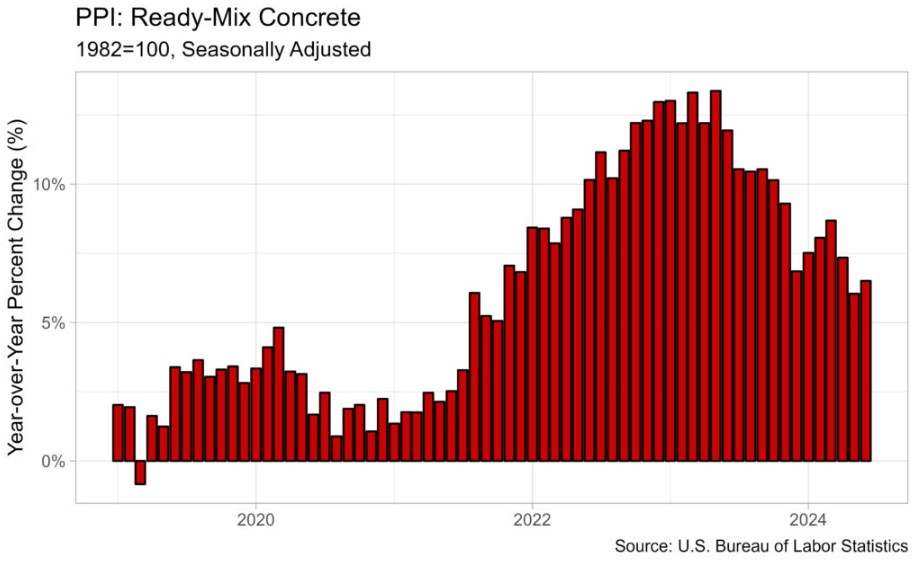

The seasonally adjusted PPI for ready-mix concrete rose, up 0.45% in June after rising a revised reading of 0.26% in May. Compared to other building materials, ready-mix concrete continues to feature year-over-year growth above five percent. This has been the trend since late 2021, as prices increased 6.51% in June 2024 compared to 2023.

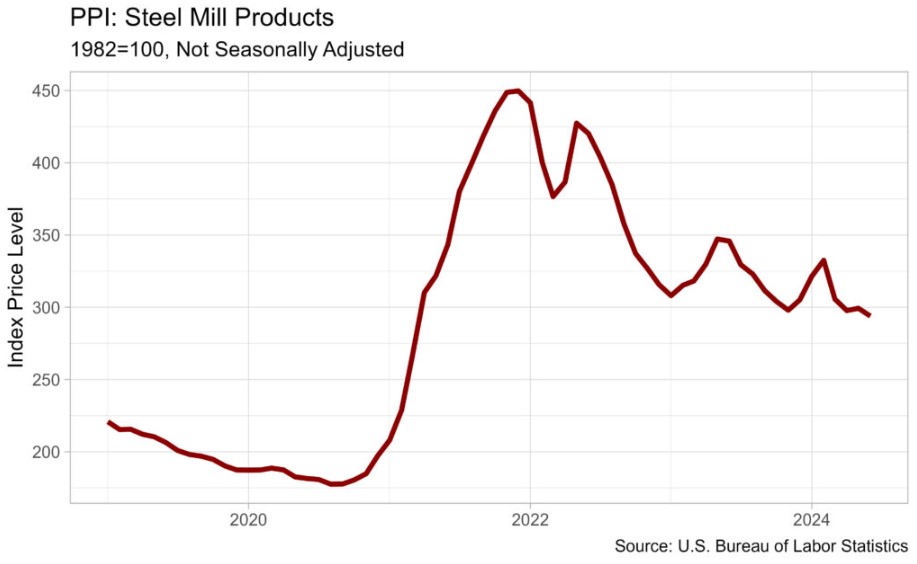

The non-seasonally adjusted PPI for steel mill products fell 1.18% in June after rising 0.54% in May. Year-over-year, steel mill product prices were lower than one year ago for the fourth straight month, down 15.01% from June of last year. This was the largest year-over-year decline since August of 2023, when the index was down 16.09%.

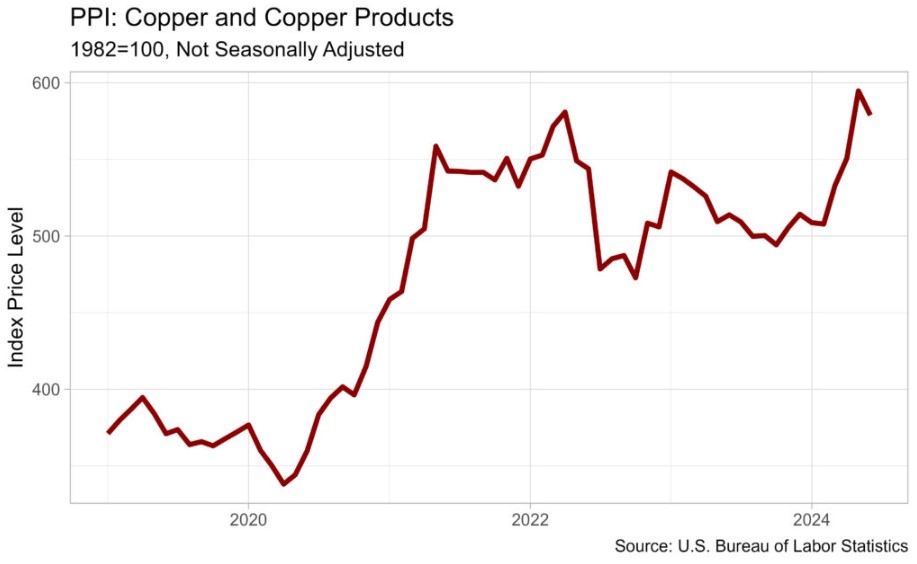

The non-seasonally adjusted special commodity grouping PPI for copper fell 2.67% in June, the first monthly decline since February of this year. Over the year, the index was up 12.64%.