LP Reports OSB Revenues Increased 53% in Q2

Originally Published by: Business Wire — August 7, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Louisiana-Pacific Corporation (LP) (NYSE: LPX), a leading manufacturer of high-performance building products, today reported its financial results for the three and six months ended June 30, 2024.

“Consistent execution of LP’s strategy, growth in Siding and Structural Solutions, and exceptional cost control and safety in Siding and OSB delivered $229M in adjusted EBITDA in the second quarter.”

Key Highlights for Second Quarter 2024, Compared to Second Quarter 2023

- Siding net sales increased by 30% to $415 million

- Oriented Strand Board (OSB) net sales increased by 53% to $351 million

- Consolidated net sales increased by 33% to $814 million

- Net income was $160 million, an increase of $181 million

- Net income per diluted share was $2.23 per share, an increase of $2.51 per share

- Adjusted EBITDA(1) was $229 million, an increase of $135 million

- Adjusted Diluted EPS(1) was $2.09 per diluted share, an increase of $1.54 per diluted share

- Cash provided by operating activities was $212 million, an increase of $124 million

(1) This is a non-GAAP financial measure. See “Use of Non-GAAP Information,” “Reconciliation of Net Income to Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted Income, and Non-GAAP Adjusted Diluted EPS" below.

Oriented Strand Board (OSB)

The OSB segment manufactures and distributes OSB structural panel products, including the innovative value-added OSB product portfolio known as LP Structural Solutions (which includes LP TechShield® Radiant Barrier, LP WeatherLogic® Air & Water Barrier, LP Legacy® Premium Sub-Flooring, LP NovaCore® Thermal Insulated Sheathing, LP FlameBlock® Fire-Rated Sheathing, and LP TopNotch® 350 Durable Sub-Flooring). OSB is manufactured using wood strands arranged in layers and bonded with resins.

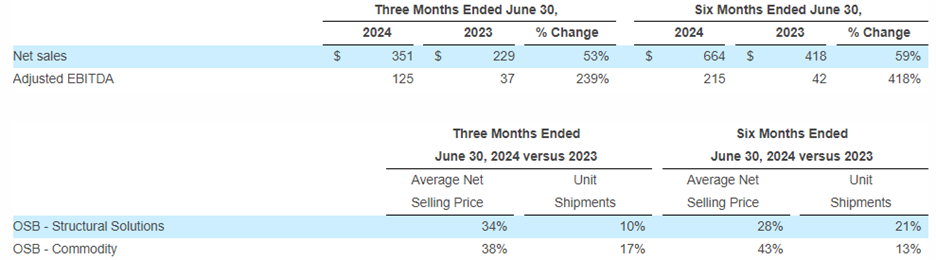

Segment sales and adjusted EBITDA for this segment were as follows (dollar amounts in millions):

Second quarter 2024 net sales for the OSB segment increased year-over-year by $122 million (or 53%), reflecting a $73 million increase in revenue due to higher OSB selling prices and a $40 million increase in sales volumes. For the six months ended June 30, 2024, the year-over-year increase in net sales of $246 million (or 59%) reflects a $135 million increase in revenue due to higher OSB selling prices and a $96 million increase in sales volumes.

Adjusted EBITDA for the three and six months ended June 30, 2024 increased year-over-year by $88 million and $174 million, respectively, reflecting the impact of higher OSB prices and sales volumes, partially offset by higher mill-related costs.

The entire financial release can be found here.