Zonda Provides New Home Market Update

Originally Published by: Zonda — September 23, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

The new home market improved slightly in August as lower interest rates hit the market

The pandemic-era housing market transformed consumer behavior. Record-low rates in 2020-2021 and the sharp increases in 2022 have made consumers more sensitive to and acutely aware of rate changes. We are seeing this play out today as consumers are monitoring Fed activity and thinking through the implications for housing affordability.

In August, mortgage interest rates averaged 6.5%, a full 35 basis points below just the month before and significantly lower than the 2024 high of 7.2% in May. While homebuilders weren’t overly enthusiastic about sales in the month, total transactions weren’t bad. Zonda’s new home sales metric rose both month-over-month and year-over-year. In addition, the Zonda Market Ranking improved month-over-month in select markets.

“The hope is that lower interest rates will help pull more consumers off the sidelines in two main ways,” said Ali Wolf, chief economist with Zonda. “For a more cost-sensitive entry-level buyer, lower interest rates can help ease the burden of the monthly mortgage payment. An existing homeowner, on the other hand, may feel more inclined to move up or move down as the gap between their current interest rate and market interest rates narrow.”

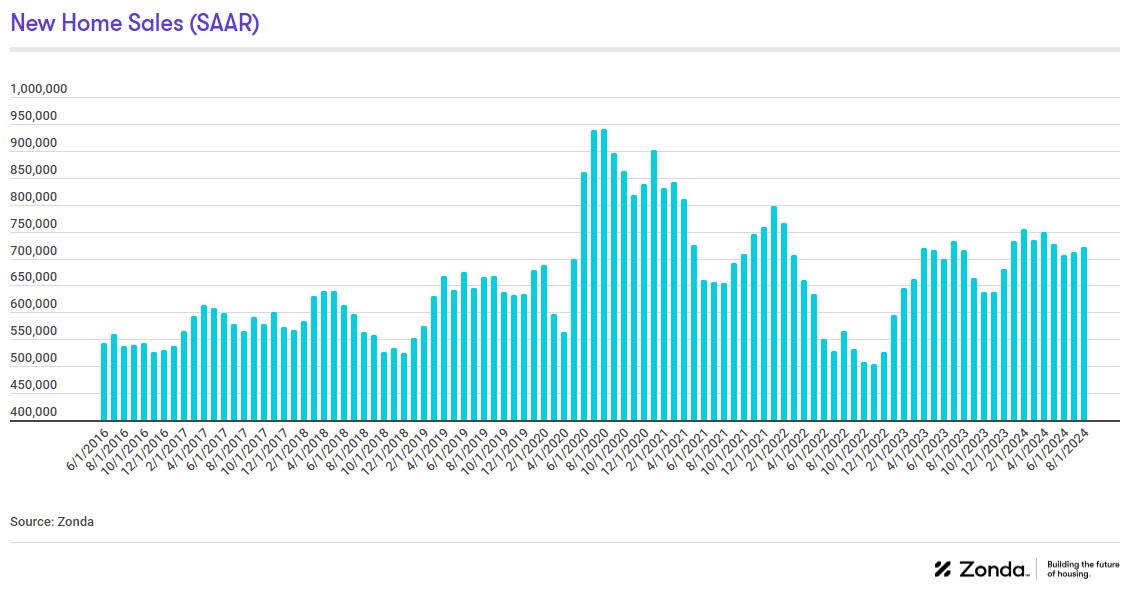

New home sales climbed month-over-month

Zonda’s new home sales metric counts the number of new home contract sales each month and accounts for both cancellations and seasonality. This metric shows there were 720,627 new homes sold in August on a seasonally adjusted annualized rate. This was a gain of 1.2% from last month and an increase of 0.7% from a year ago. On a non-seasonally adjusted basis, 60,032 homes were sold, 2.0% higher than last year and 10.5% above the same month in 2019.

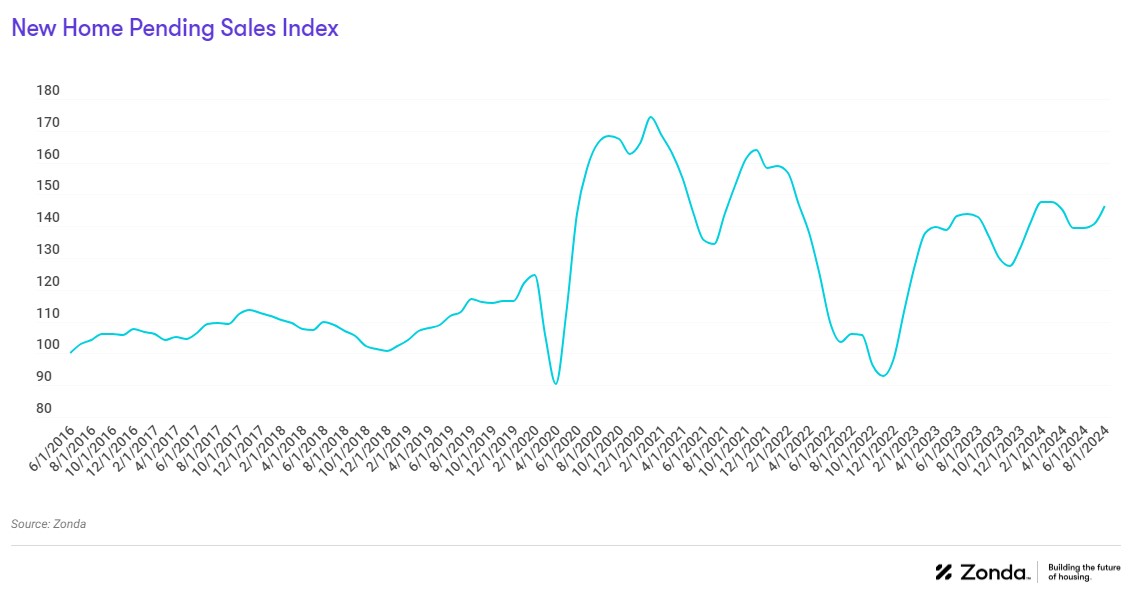

A lift in sales adjusted for supply

Total sales volume is influenced by both supply and demand. Zonda’s New Home Pending Sales Index (PSI) was created to help account for fluctuations in supply by combining both total sales volume with the average sales rate per month per community. The August PSI came in at 146.3, representing a 2.3% rise from the same month last year. On a month-over-month basis, seasonally adjusted new home sales increased 4.0%. The index is currently 16.0% below cycle highs.

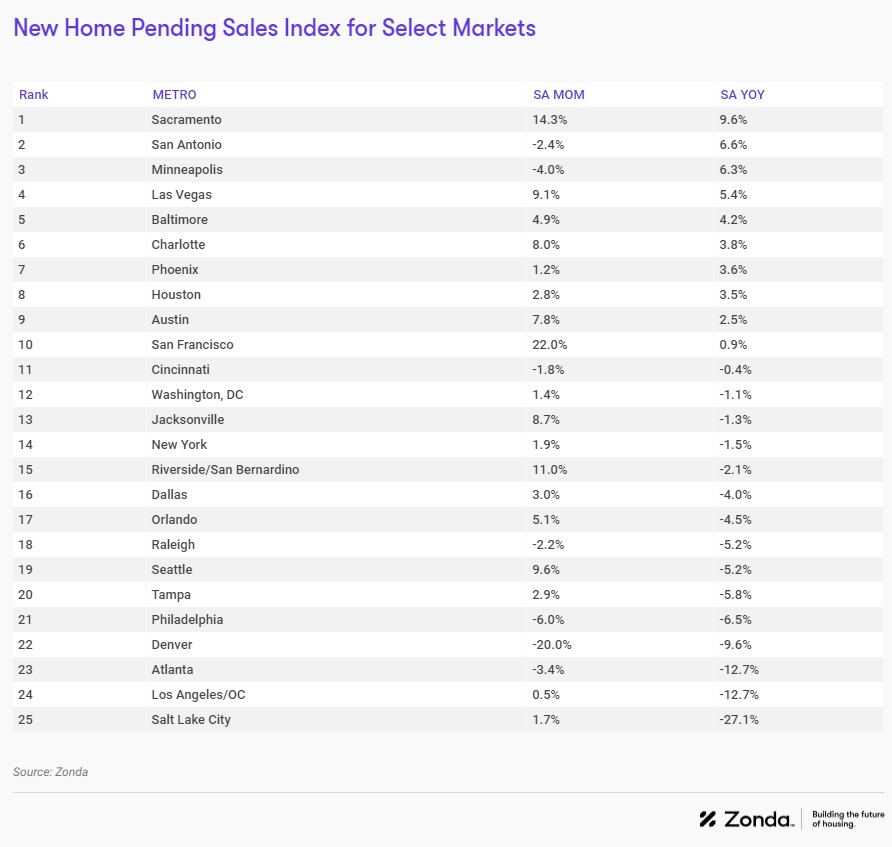

- The markets that posted the best numbers relative to last year were Sacramento (+9.6%), San Antonio (+6.6%), and Minneapolis (+6.3%).

- Sales were down year-over-year in 15 of our select markets, led by Salt Lake City, Los Angeles/OC, and Atlanta.

- On a monthly basis, San Francisco, Sacramento, and Riverside/San Bernardino were the best performing markets, with San Francisco increasing 22.0% relative to last month.

The ZMR captured a stable market

In order to add further context to sales, Zonda created the Zonda Market Ranking (ZMR). The ZMR accounts for both sales pace and volume, is seasonally adjusted, and is taken as a percentage relative to a baseline market average. Based on the percentage above or below baseline, markets are bucketed into performance groups ranging from significantly underperforming to significantly overperforming relative to historical activity.

The map below shows a snapshot of the top production markets by region. Zonda also offers the ZMR for entry-level, move-up/move-down, and high-end markets. Subscribers of the National Outlook report can access all top markets and the tiered breakdown in Zonda’s portal. Non-subscribers can access the tiered maps for the select 10 markets by clicking below.

- The National ZMR index came in at 117.6 in August, indicating a slightly overperforming market, ranking in line with last month and this time last year.

- Zonda’s snapshot markets were split between 50% overperforming, 30% average, and 20% underperforming in August.

- Among Zonda’s top 50 major markets, 64% were overperforming, 20% were average, and 16% were underperforming.

- Importantly, the ZMR does not account for what it takes to sell a home. For example, securing a sale might still feel difficult in a significantly overperforming market, but if incentives offered result in a sale, we count the sale.

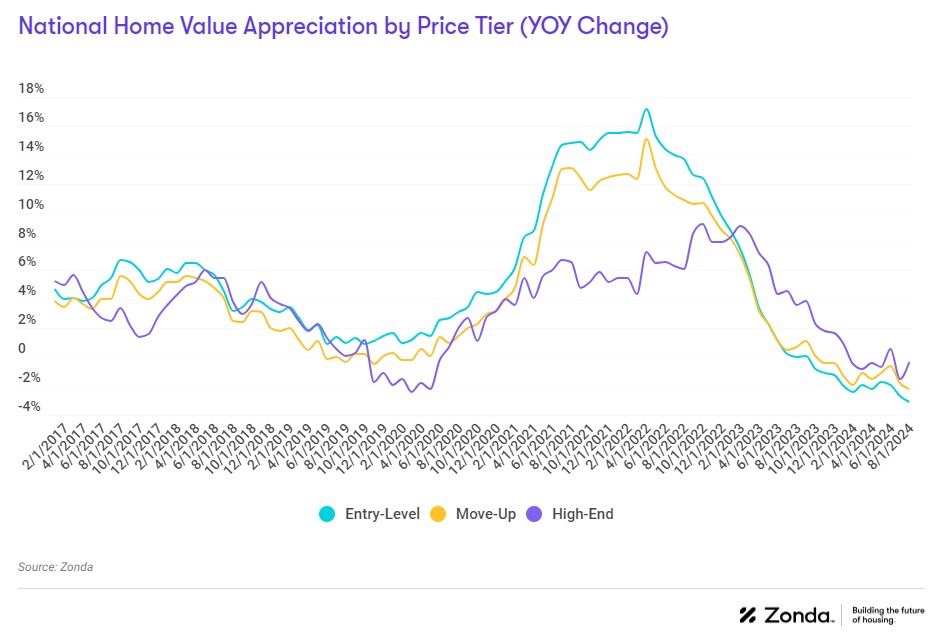

New home prices were down for a few reasons

National home prices decreased year-over-year across entry-level, move-up, and high-end homes. Prices fell 3.1% for entry-level to $329,307, 2.2% for move-up to $517,938, and 0.3% for high-end homes to $911,064. The declines represent a mix of select price drops, smaller home sizes, and differing locations.

Supplementing our data with a monthly survey Zonda conducts, 15% of builders lowered prices in August, 65% held prices flat, and 20% raised prices. In July, for comparison, 18% of builders lowered prices MOM, 66% held prices flat, and 16% increased prices.

Incentives are still common in today’s housing market to help address the affordability constraints for buyers. 58% of new home communities across the country offered incentives in August, the same percentage as last month. Zonda’s builder survey captured that the majority of builders are offering mortgage rate buydowns, with 50% of builders reporting they are willing and able to offer a buydown between the low-4%s and the low-5%s.

QMI supply was down almost 7%

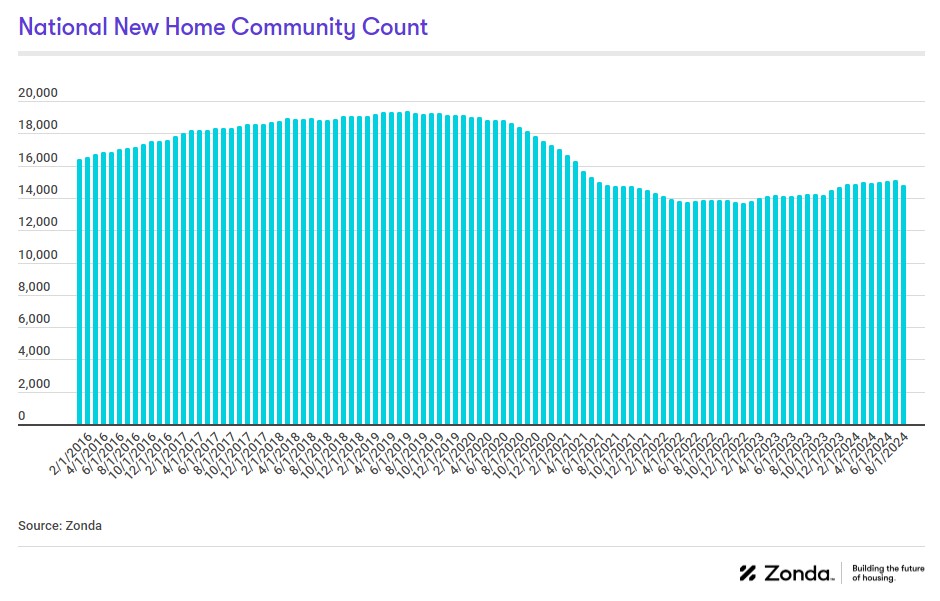

There are currently 14,793 actively selling communities tracked by Zonda, up 3.7% from last year. On a month-over-month basis, the national figure slipped 2.2%. Total community count is 23.0% below the same month in 2019. Zonda defines a community as anywhere where five or more units are for sale.

- Dallas (+14.8%), Baltimore (+9.6%), and Atlanta (+9.3%) grew community count the most year-over-year.

- Relative to last year, the biggest community count declines were in San Francisco (-20.8%), Los Angeles/OC (-18.9%), and Riverside/San Bernardino (-14.4%), three markets with extremely tight land supply.

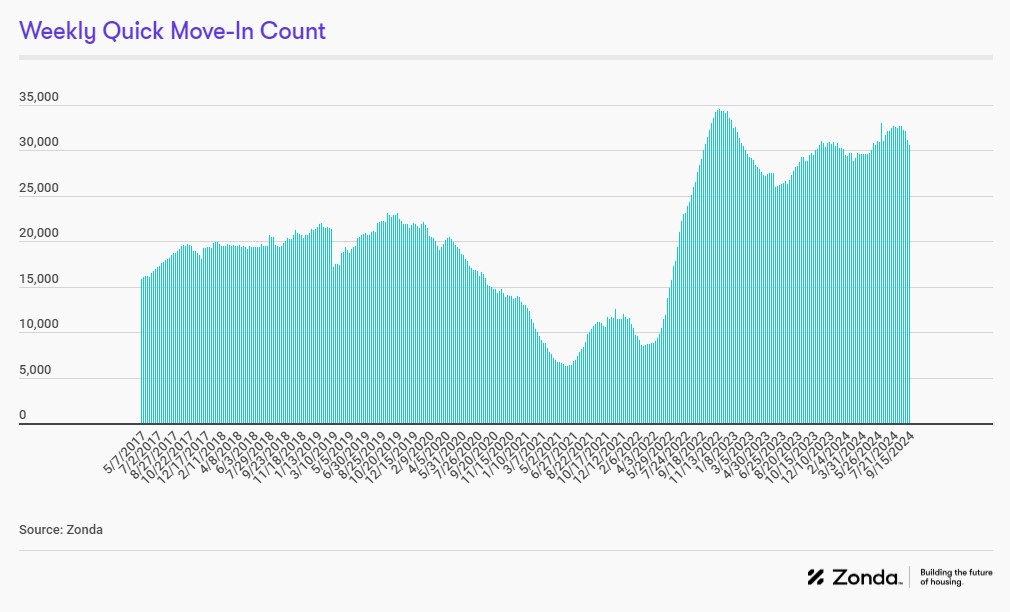

National quick move-ins (QMIs) totaled 30,578, up 7.7% compared to last year but 6.6% lower month-over-month. Total QMIs are 32.3% above 2019 levels. QMIs are homes that can likely be occupied within 90 days.

For many consumers, QMIs provide a great option given the lack of resale supply. As a result, some builders have pivoted to a more spec-heavy strategy to help capture today’s buyers. In some markets, however, resale inventory is rising and QMIs have become less desirable than 6 months ago.

- On a metro basis, 48% of Zonda’s select markets increased QMI count year-over-year.

- The markets that grew the most year-over-year were Philadelphia (+67.3%), Charlotte (+42.9%), and Orlando (+35.2%).

- Las Vegas, Cincinnati, and Salt Lake City have seen the most growth in QMIs compared to the same time in 2019, up 187.1%, 182.2%, and 170.9%, respectively.

Are you interested in seeing past National Housing Market Update and Pending Sales Index reports? Access our report library to learn more.

Methodology

The Zonda New Home Pending Sales Index (PSI) is built on proprietary, industry-leading data that covers 60% of the production new home market across the United States. Reported number of new home pending contracts are gathered and analyzed each month. Released on the 15th business day of each month, the New Home PSI is a leading indicator of housing demand compared to closings because it is based on the number of signed contracts at a new home community. Zonda monitors 18,000 active communities in the country and the homes tracked can be in any stage of construction.

The new home market represents roughly 10% of all transactions, allowing little movements in supply to cause outsized swings in market activity. As a result, the New Home PSI blends the cumulative sales of activity recently sold out projects with the average sales rate per community, which adjusts for fluctuations in supply. Furthermore, the New Home PSI is seasonally adjusted based on each markets’ specific seasonality, removes outliers, and uses June 2016 as the base month. The foundation of the index is a monthly survey conducted by Zonda. It is necessary to monitor both new and existing home sales to establish an accurate picture of the relative health of the residential real estate market.