2025 Promises Renewed Optimism...with a Vengeance

Originally Published by: ProBuilder — December 8, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

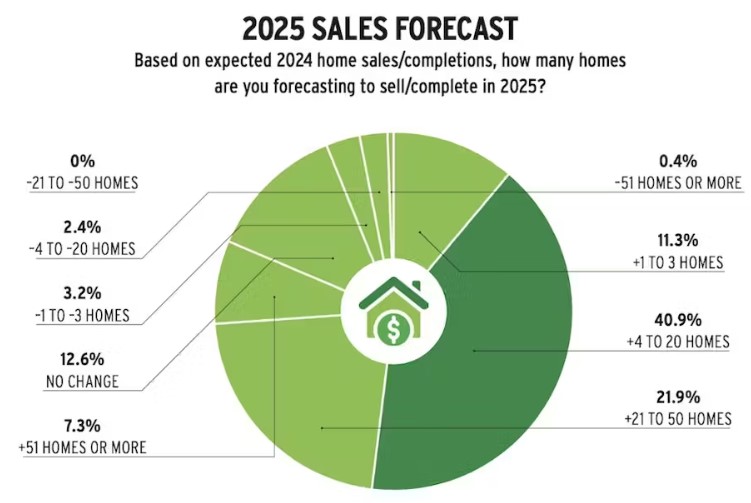

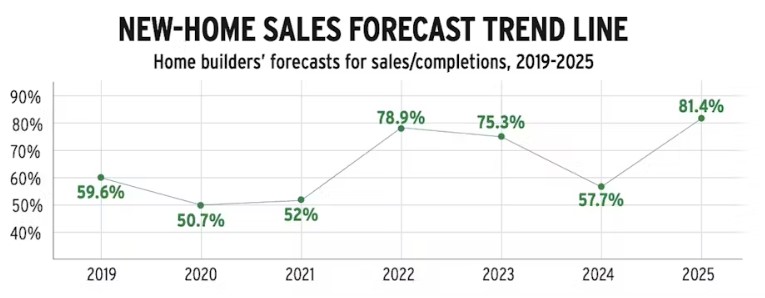

When more than 81% of home builders responding to Pro Builder’s annual survey predict they’ll sell or complete more homes in 2025 than they did this year—and half of those forecast building up to 20 additional units—it is tempting to think it’s hyperbole ... especially when less than 60% of builders expected to increase production in 2024 and barely half predicted growth after a strong 2019 (scroll down to see the trend line chart, below).

If their predictions hold true, it won’t be magic or mystery but basic blocking and tackling and a few stars aligning (read: lower interest rates and loosened regulations) at the right time.

“We expect to achieve solid business growth by optimizing products and services, expanding market share, and improving customer satisfaction [to drive] revenue and profit,” said one survey respondent.

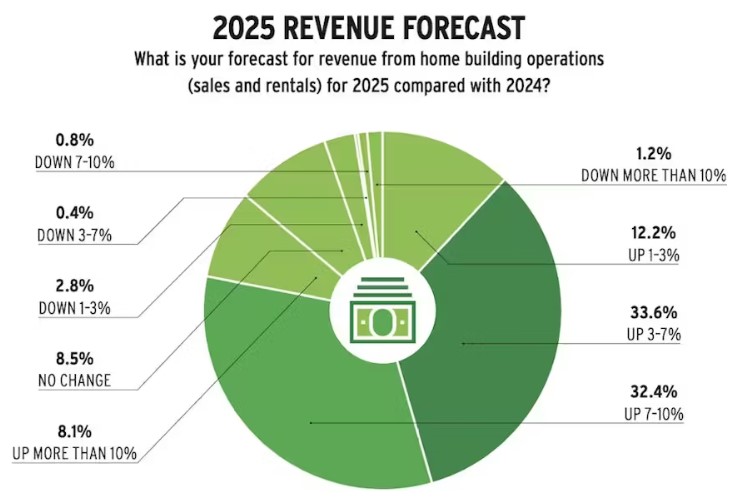

As one might expect, revenue predictions for the coming year are equally optimistic, with nearly 86% of builders expecting a boost next year. Nearly half of those expect a spike of 7% or more, while only 8.5% predicit sales will remain flat in 2025 (see chart below).

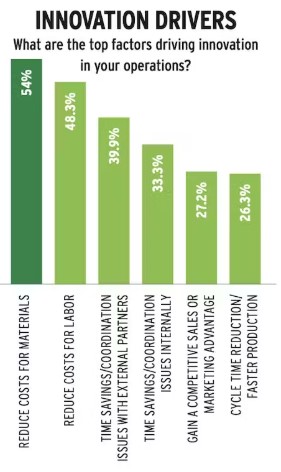

Others mentioned a renewed interest in innovation to help speed production and alleviate cost pressures. And more than 80% of builders report having a research and development department to lead those efforts (see chart below).

“We expect to make breakthroughs in product R&D and technological innovation, and constantly introduce competitive new products and services to meet market demand and enhance the company’s core competitiveness,” offered one survey respondent.

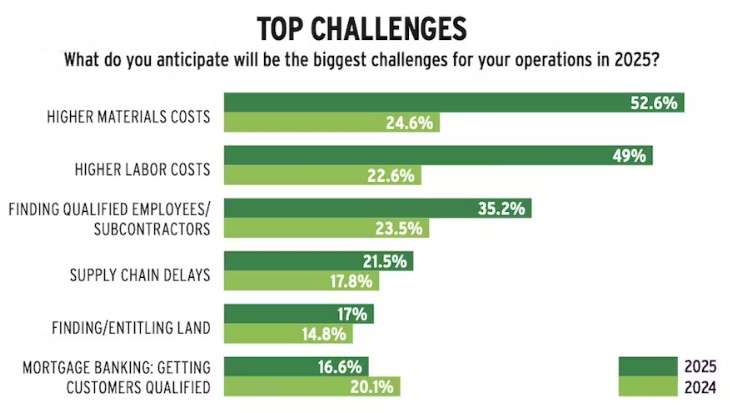

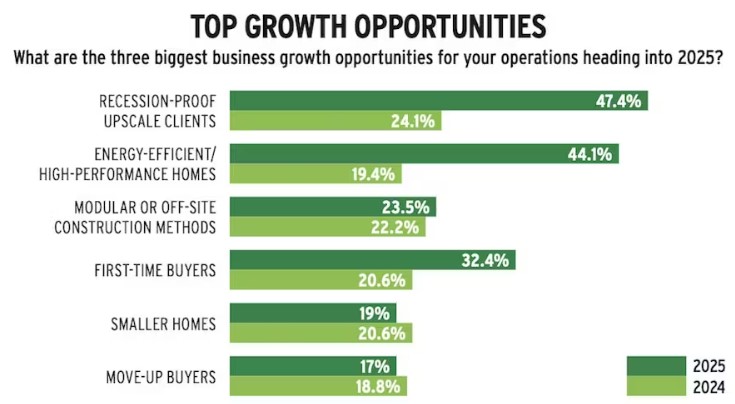

What might hold them back? Higher materials and labor costs and finding qualified employees or trade partners lead the list of challenges (see the full list below), while "recession-proof" upscale clients and energy-efficient/high-performance homes top the list of growth opportunities.

Most home builders also will rely on the overall economy to continue its upward trend, and some are taking more responsibility for their performance. “We may change our policy and actively seek out better strategies,” one respondent told us. “I believe we’ll be bigger and stronger in the coming year.”

Methodology and Respondent Information: The 2025 Readers’ Forecast Survey was distributed to Pro Builder print and digital audiences in October and November 2024, as well as to builder members and clients of Shinn Builder Partnerships, SMA Consulting, IBACOS, and the Housing Innovation Alliance. Recipients were offered the chance to win one of four $100 Visa gift cards for completing the online survey, with gift cards awarded in December 2024. A total of 247 surveys were completed. The source of all data shown is from the survey.

After cautious predictions a year ago, more than 81% of builders expect to sell or complete more homes in 2025, indicating that market conditions, namely continued high demand, lower mortgage interest rates, and perhaps looser regulations, will spur housing production.

With more sales (see previous chart) comes (a lot!) more revenue. 86.3% of builders expect more money coming in, and nearly half predict 7% or higher revenue growth during 2025. This time last year, just 62% of survey respondents anticipated revenue growth and another 24.6% expected their revenue to decline in 2024.

Builder optimism for 2025 home sales is the highest it’s been since the pandemic hit at the end of 2019. Optimism rekindled for 2022 and 2023, but dipped sharply going into 2024.

Predictions for more production in 2025 (see previous chart) brought back concerns about labor and materials costs and supply, while challenges that ranked higher last year (government regulation, fees and taxes, and home price appreciation) pose far less concern in the coming year.

Do builders sense an impending recession? Probably not. Will there be more demand for energy-efficient homes, given high inflation since 2022 through most of 2024? Maybe. Will off-site methods help boost predicted production gains in 2025? Signs are there. Regardless, builders seem poised to get back to basics.

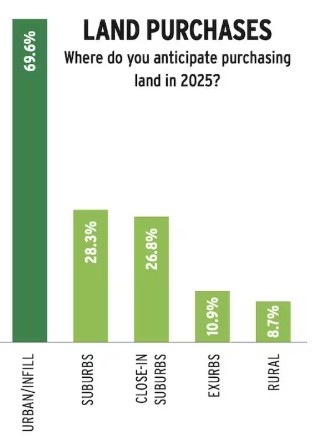

Of the nearly 60% of builders that said they plan to purchase land in 2025, the vast majority see opportunity in urban and infill lots, leaving the exurbs to higher-volume builders in search of larger parcels and cheaper pricing.

No surprise! Innovation for home builders is all about becoming more efficient and making more sales. Improving construction quality isn’t far behind (22.8%), but meeting customer expectations (7.5%) and adapting to changing codes and regulations (6.6%) will not move this needle in 2025.