Chart: Concrete Volatility Reminiscent of Lumber Woes

Originally Published by: NAHB — December 9, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

The prices of building materials decreased 0.3% in November (not seasonally adjusted) following 0.5% and 0.1% declines in September and October, respectively, according to the latest Producer Price Index (PPI) report. The index has decreased five of six months for the first time since 2015.

The PPI for goods inputs to residential construction, including energy, fell 0.8% in November. The index was led lower by a 5.3% drop in energy input prices as the PPIs of regular unleaded gasoline and #2 diesel fuel—which make up more than 80% of energy inputs to residential construction—decreased 6.7% and 4.5%, respectively.

The price index of services inputs to residential construction increased 0.6% in November. It marked the second consecutive monthly increase after six straight months of falling prices.

Prices were propelled higher by large increases in the price of financial and real estate services. The PPI for business loans climbed 14.1% in November and the price of securities brokerage and dealing services soared 24.5%. Trucking and ocean freight costs increased as well.

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) fell 0.1%, the fourth consecutive monthly decline and seventh decrease in the past eight months. Softwood lumber prices have dropped 42.2% since March.

It is noteworthy that the prices of some further-processed lumber products have increased substantially over the past two years. For example, millwork prices have climbed 25.9% since January 2021. Meanwhile, softwood lumber prices dropped 24.4% over the same period.

The magnitude of monthly changes in lumber prices has decreased significantly since July following two and a half years of historic volatility.

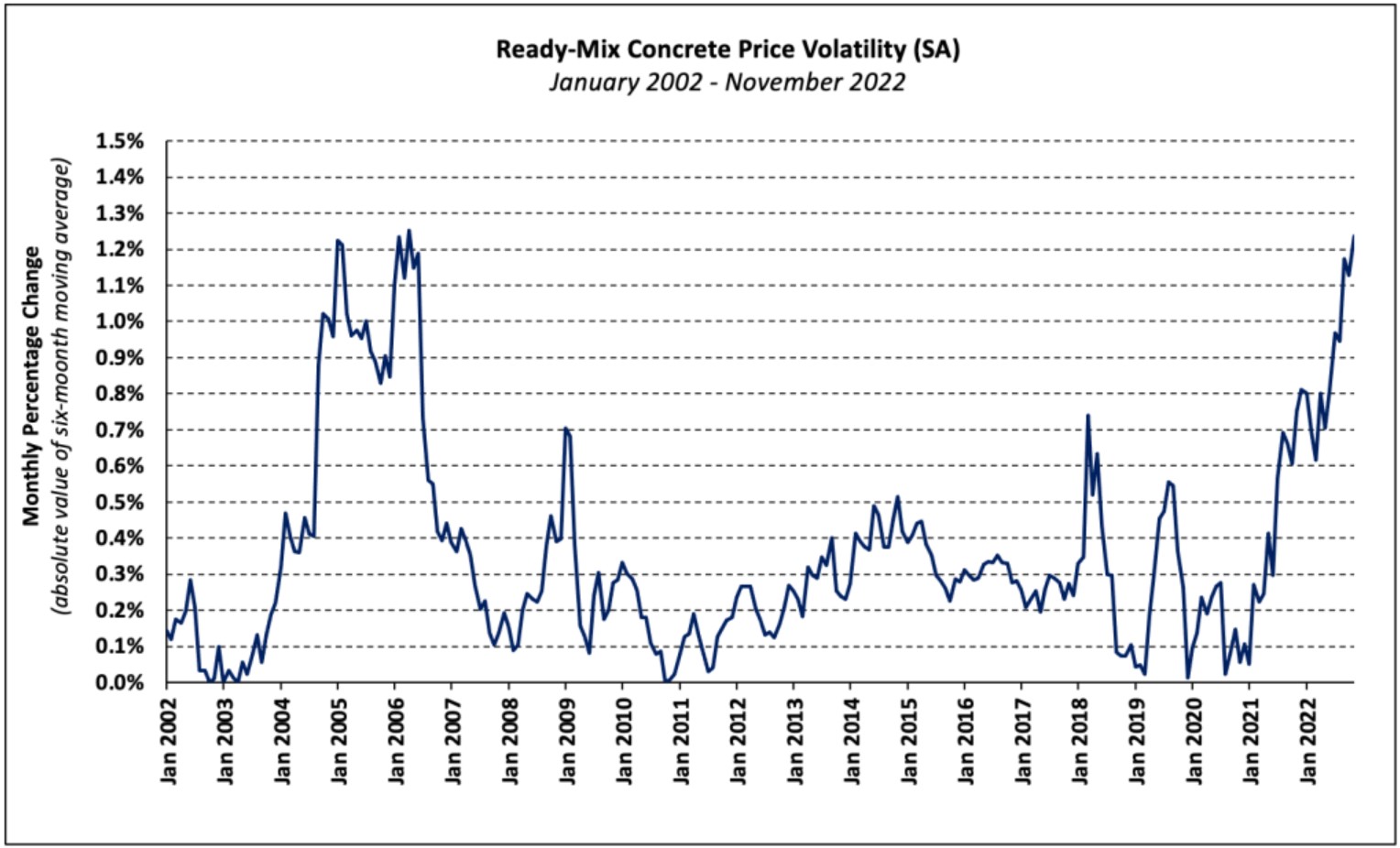

Ready-Mix Concrete

The trend of ready-mix concrete (RMC) prices continued its torrid pace as the index increased 1.1% in November. The PPI for RMC has increased 21 of the past 22 months and is up 20.0% over the period. The index has climbed 10.7%, year-to-date, the largest November YTD increase in the series’ 34-year history and four times the pre-pandemic average November YTD record.

The monthly increase in the national data was entirely driven by a 3.8% price increase in the Midwest. Prices edged up in the Northeast and West regions while declining in the South. The West has experienced the largest increase since January 2021 (+27.7%) while the smallest increase over the period has been in the Northeast.

Unlike softwood lumber, volatility continues to be an issue in the RMC market and is just shy of the record high set in the middle of the housing boom.

Gypsum Building Materials

The PPI for gypsum building materials moved 0.5% higher in November—more than offsetting the small decline in October. Prices have increased 11.4% YTD, 18.0% over the past year, and 39.3% since January 2021.

However, the rate of increases has slowed in 2022 compared to the same period in 2021 as the average monthly increase this year has been 1.0%. The average in 2021 was 1.6%.

Steel Mill Products

Steel mill products prices decreased 3.0 % in November after declining 5.5% in October. Prices have fallen 22.9% since May 2022, posting declines each month. Although the index is at its lowest level since May 2021, the pace of monthly decreases has consistently slowed.

Transportation of Freight

The price of truck, rail, and ocean transportation of freight each increased in November. Trucking freight prices rose 1.0%, snapping a five-month streak of decreases. The indexes for rail and ocean transportation of freight climbed 0.6% and 1.5%, respectively.