Chart: Construction Job Openings May Have Peaked

Originally Published by: NAHB — January 4, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

The count of open, unfilled jobs for the overall economy declined slightly in November, falling from 10.51 million open positions to 10.46 million. This represents a decrease from a year ago (10.92 million), a sign the labor market is slowing in response to tighter monetary policy. The degree of this slowing will be critical for the ongoing downshift in the size of rate hikes from the Fed during the first quarter.

Ideally, the count of open, unfilled positions slows to the 8 million range in the coming quarters as the Fed’s actions cool inflation. While higher interest rates are having an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing demand, but by recruiting, training and retaining skilled workers.

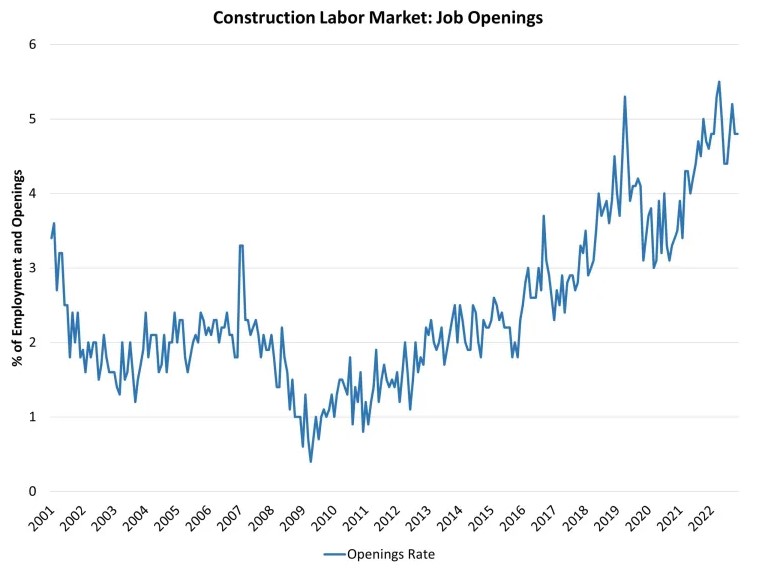

The construction labor market saw a decline for job openings in November as the housing market cools. The count of open construction jobs decreased from 390,000 to 388,000 month-over-month. The November reading is actually higher than the estimate from a year ago (366,000), a reminder of the persistent challenges of the skilled labor crisis in construction.

The construction job openings rate was relatively unchanged this month, holding at 4.8%. The data series high rate of 5.5% was recorded in April 2022. Given the outlook for construction, it now seems clear the count and rate of open, unfilled positions for the construction industry peaked in 2022 and is now trending lower as the housing market slows.

The housing market remains underbuilt and requires additional labor, lots and lumber and building materials to add inventory. However, the market has slowed due to higher interest rates. Nonetheless, hiring in the construction sector weakened to a 4% rate in November. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a post-covid rebound took hold in home building and remodeling.

Construction sector layoffs held at a 1.7% rate in November. In April 2020, the layoff rate was 10.8%. Since that time, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects. The number of layoffs in construction fell back to 129,000, compared to 150,000 a year ago.

The number of quits in construction in November (138,000) was significantly lower than the measure a year ago (215,000).

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. However, while a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond the ongoing macro slowdown.