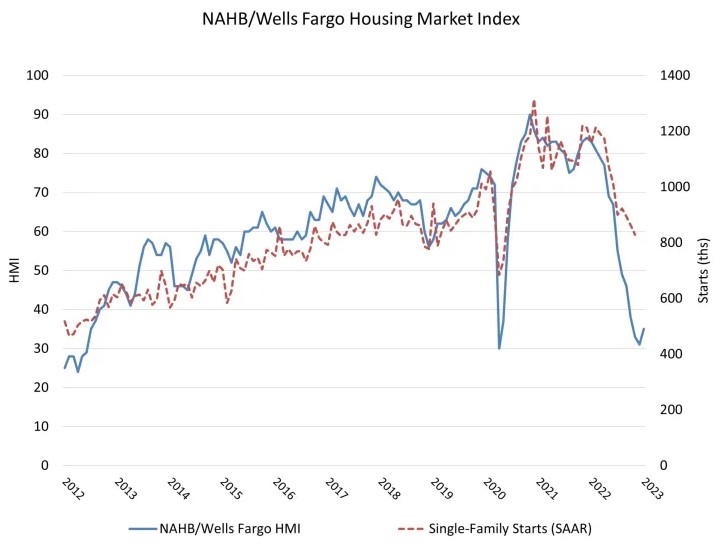

Chart: Home Builder Confidence Bounces Up

Originally Published by: NAHB — January 18, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

A modest drop in interest rates helped to end a string of 12 straight monthly declines in builder confidence levels, although sentiment remains in bearish territory as builders continue to grapple with elevated construction costs, building material supply chain disruptions and challenging affordability conditions.

Builder confidence in the market for newly built single-family homes in January rose four points to 35, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

It is possible that the low point for builder sentiment in this cycle was registered in December, even as many builders continue to use a variety of incentives, including price reductions, to bolster sales. The rise in builder sentiment also means that cycle lows for permits and starts are likely near, and a rebound for home building could be underway later in 2023.

While NAHB is forecasting a decline for single-family starts this year compared to 2022, it appears a turning point for housing lies ahead. In the coming quarters, single-family home building will rise off of cycle lows as mortgage rates are expected to trend lower and boost housing affordability. Improved housing affordability will increase housing demand, as the nation grapples with a structural housing deficit of 1.5 million units.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI indices posted gains for the first time since December 2021. The HMI index gauging current sales conditions in January rose four points to 40, the component charting sales expectations in the next six months increased two points to 37 and the gauge measuring traffic of prospective buyers increased three points to 23.

Looking at the three-month moving averages for regional HMI scores, the West registered a one-point gain to 27, the South held steady at 36, the Northeast fell four points to 33 and the Midwest dropped two points to 32.

The HMI tables can be found at nahb.org/hmi.