Chart: Home Builders Say Material Costs and Availability a Problem

Originally Published by: NAHB — February 13, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

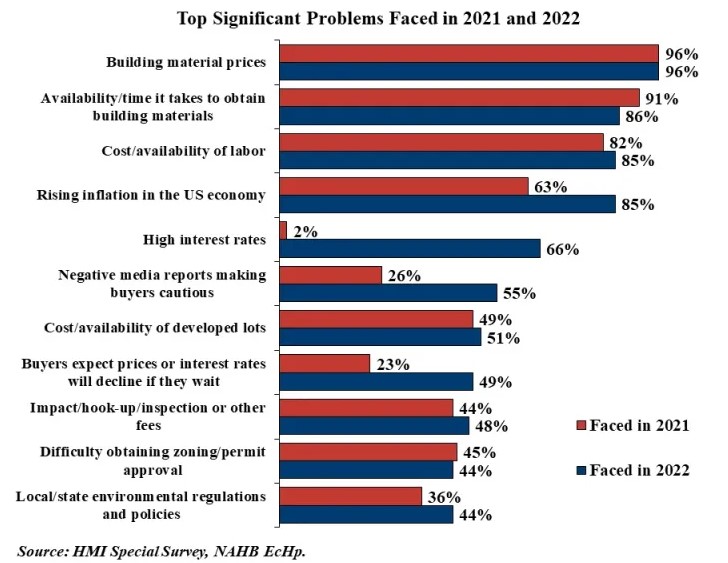

The price and availability of building materials again topped the list of problems builders faced last year, while interest rates (along with general inflation and negative media reports) moved considerably up the list. According to special questions on the January 2023 survey for the NAHB/Wells Fargo Housing Market Index, building material prices were a significant issue for 96% of builders in 2022. The second most widespread problem in 2022 was availability/time it takes to obtain building materials, cited by 86% of builders. These were the same two problems that topped the list in 2021. Cost and availability of labor has also been a relatively widespread problem, reported as a significant by 82% of builders in 2021 and 85% in 2022, a result that is not surprising given the large number of unfilled job openings in the construction industry.

Compared to 2021, some of the problems became significantly more widespread in 2022. High interest rates were a problem for only 2% of builders in 2021, but this increased to 66% in 2022. Rising inflation in the US economy was a significant problem for 63% of builders in 2021, compared to 85% in 2022. And 26 percent of builders said negative media reports making buyers cautious was a significant problem in 2021, compared to 55 percent in 2021.

Even more builders—a full 93%—expect high interest rates to be a problem in 2023, up strongly from the 66% who said it was a problem in 2022. Moreover, both the current and expected numbers were much higher in the recent survey than at any time in the 2011-2021 span.

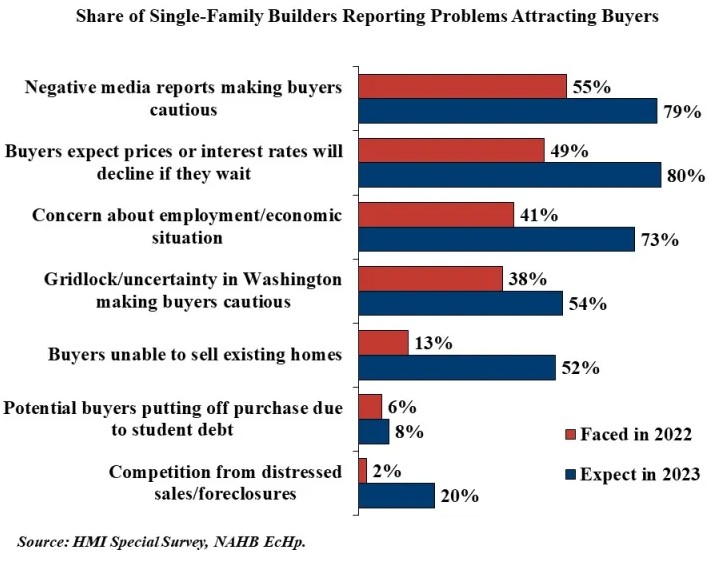

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2023. Negative media reports making buyers caution was a significant problem for 55% of builders in 2022, but 79% expect them to be a problem in 2023. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 49% of builders in 2022, compared to 80% who expected it to be an issue in 2023. Concern about employment/economic situation was a problem for only 41% of builders in 2022, but 73% expect it to be a problem in 2023. Gridlock/uncertainty in Washington making buyers cautious was a significant problem for 38% of builders in 2022, compared to 54% who expected it to be a problem in 2023. Finally, buyers unable to sell their existing homes was a significant problem for only 13% of builders in 2022, but 52% expect it to be a problem in 2023.

For additional details, including a complete history for each reported and expected problem listed in the survey, please consult the full HMI January2023 Special Survey REPORT.