Chart: Inflation Experiences 6 Months of Deceleration

Originally Published by: NAHB — January 12, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Consumer prices in December saw the largest month-over-month decrease since April 2020. While still elevated, inflation experienced the third month below an 8% annual growth rate since February 2022. Moreover, this was the sixth consecutive month of a deceleration.

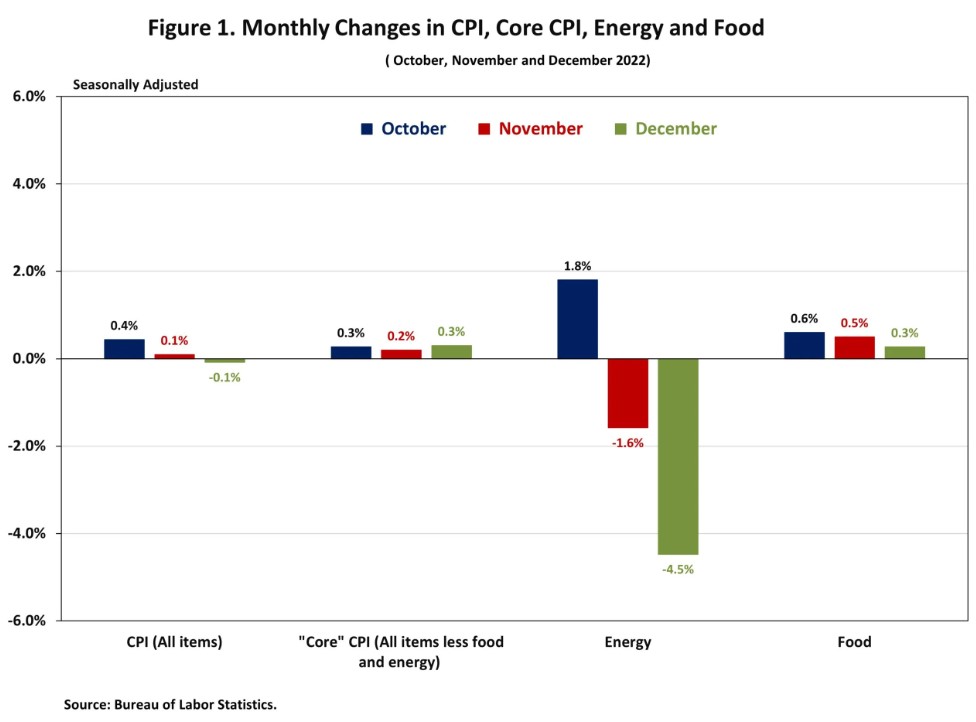

However, the shelter index (housing inflation) continued to rise at an accelerated pace and was the largest contributor to the total increase. Shelter inflation will primarily be cooled in the future via additional housing supply. While inflation appears to have peaked and continues to slow, inflation in core service (excluding shelter) has not begun to ease. However, real-time data from private data providers indicate that rent growth is cooling, and this is not yet reflected in the CPI data. It will be reflected in the coming months.

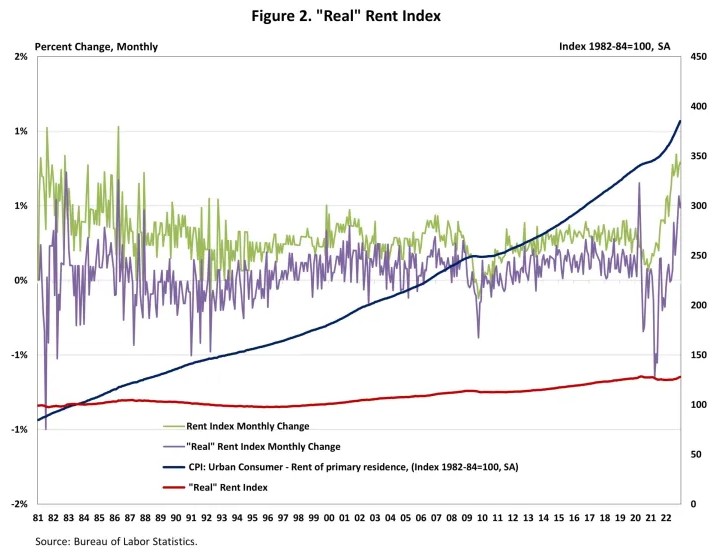

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) fell by 0.1% in December on a seasonally adjusted basis, following an increase of 0.1% in November. The price index for a broad set of energy sources decreased by 4.5% in December as a decline in gasoline (-9.4%) offset an increase in electricity (+1.0%) and natural gas index (+3.0%). Excluding the volatile food and energy components, the “core” CPI rose by 0.3% in December, following an increase of 0.2% in November. Meanwhile, the food index increased by 0.3% in December with the food at home index rising 0.2%.

Most component indexes continued to increase in December. The indexes for shelter (+0.8%), household furnishings and operations (+0.3%), recreation (+0.2%), motor vehicle insurance (+0.6%), education (+0.3%) as well as apparel (+0.5%) showed sizeable monthly increases in December. Meanwhile, the indexes for used cars and trucks (-2.5%), new vehicles (-0.1%), personal care (-0.1%) and airline fares (-3.1%) declined in December.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.8% in December, following an increase of 0.6% in November. Both the indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) increased by 0.8% over the month. Monthly increases in OER have averaged 0.7% over the last three months. These gains have been the largest contributors to headline inflation in recent months. These higher housing costs are driven by lack of attainable supply and higher development costs. Higher interest rates will not slow these costs, which means the Fed’s tools are limited in addressing shelter inflation.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 6.5% in December, following a 7.1% increase in December. This was the slowest annual gain since October 2021. The “core” CPI increased by 5.7% over the past twelve months, following a 6.0% increase in November. The food index rose by 10.4% and the energy index climbed by 7.3% over the past twelve months. These decelerating measures indicate the Fed’s actions are having a measurable impact on inflation and reinforce the call for the Fed to slow its tightening of monetary policy.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

The Real Rent Index rose by 0.5% in December. Over the twelve months of 2022, the monthly change of the Real Rent Index increased by 0.2%, on average.