Chart: Lack of Resales Boosting New Home Market

Originally Published by: NAHB — May 23, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Stabilizing mortgage rates and a lack of resale inventory provided a boost for new home sales in April, even as builders continue to wrestle with rising costs stemming from shortages of transformers and other building materials and a persistent lack of construction workers.

Sales of newly built, single-family homes in April increased 4.1% to a 683,000 seasonally adjusted annual rate from a downwardly revised reading in March, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. This is the highest level since March 2022. However, sales are down in 2023 thus far by 9.7%. Sales may weaken in the months ahead given the rise for interest rates at the end of May.

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the April reading of 683,000 units is the number of homes that would sell if this pace continued for the next 12 months.

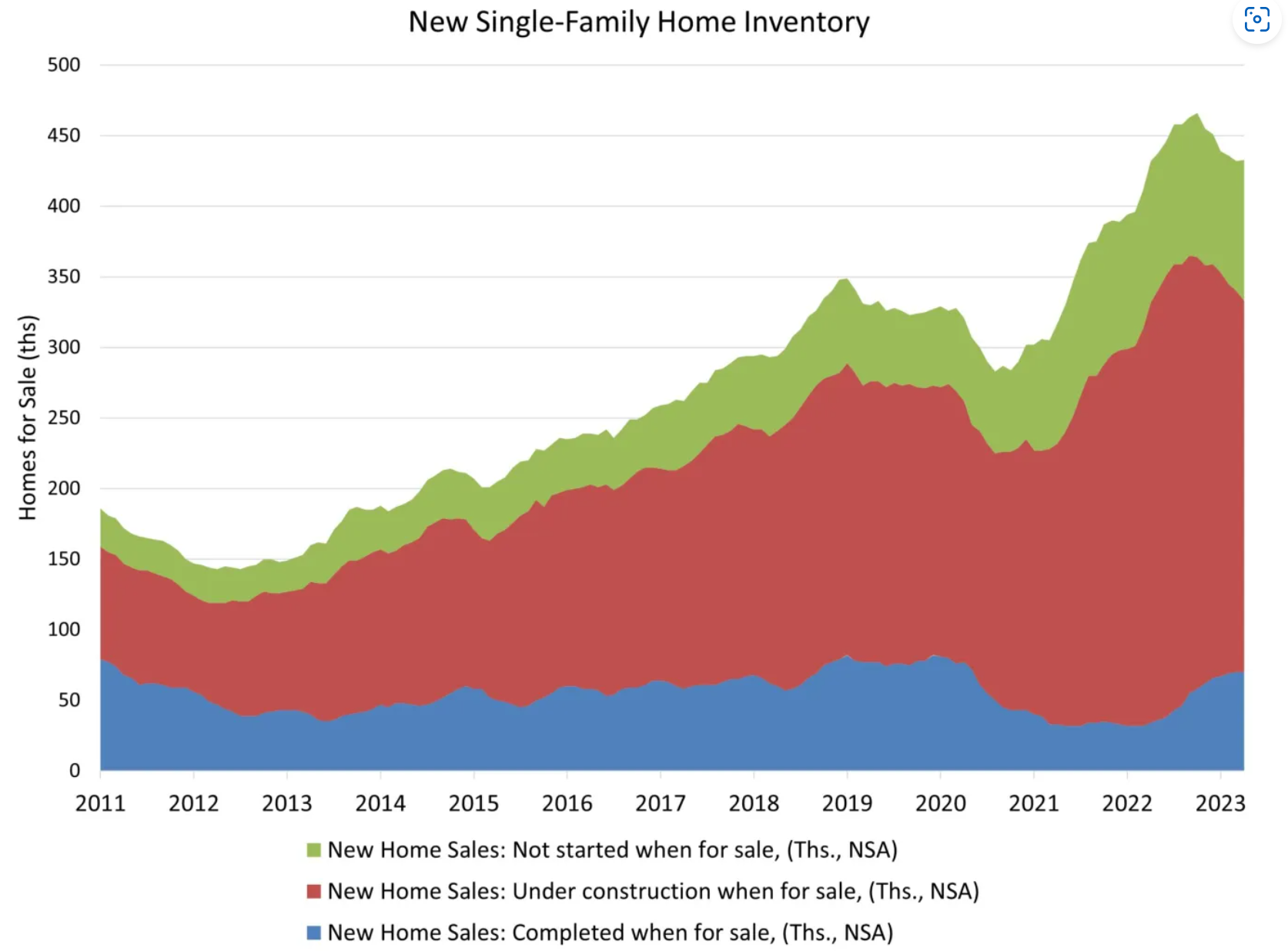

New single-family home inventory increased 0.2% in April and remained elevated at a 7.6 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. However, the lack of resale, existing home inventory means that overall inventory for the single-family market remains tight.

April’s data showed a jump for new homes available for sale and sold that had not started construction. Sales of homes not started construction reached their highest mark in more than a year. Homes available for sale that had not started construction were at the highest pace since October of last year. This reflects an increase in the spec home building market.

The median new home sale price fell in April to $420,800 and was down 8% compared to a year ago. The report showed growth in the lower price ranges, with 9,000 sales in the $200,000-$299,999 price range in April 2023, compared to just 4,000 sales a year prior. The $300,000-$399,999 price bracket grew by 14,000 sales in that same time frame.

Regionally, on a year-to-date basis, new home sales fell in all regions, down 19.2% in the Northeast, 9.8% in the Midwest, 0.7% in the South and 27.5% in the West.