Chart: Lumber Volatility Reaches 75-Year High

Originally Published by: NAHB — January 14, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

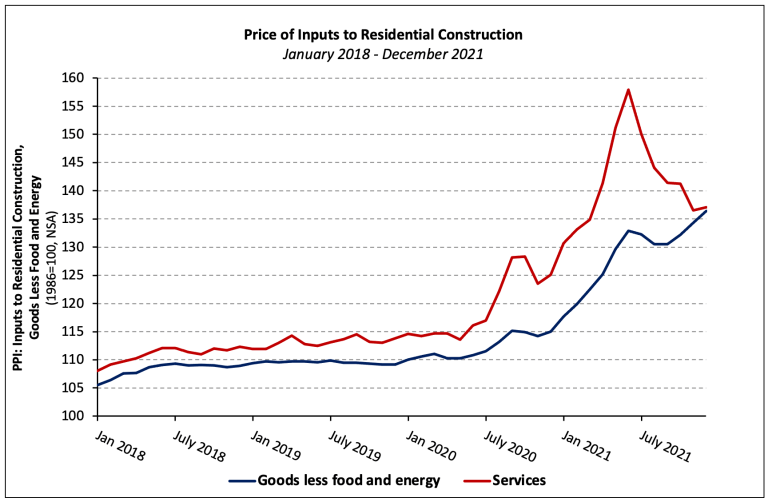

The prices of goods used in residential construction ex-energy climbed 1.5% in December (not seasonally adjusted), according to the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics. The index was driven higher by large price increases for wood products.

Building materials prices increased 15.9% in 2021 and have risen 18.6% since December 2020. Since declining 1.8% between July and August 2021, the index has climbed 4.5%.

The price index of services inputs to residential construction increased 0.4% in December following a five-month period over which the index declined 13.6%. The index is 9.6% higher than it was 12 months prior and 19.6% higher than the January 2020 reading.

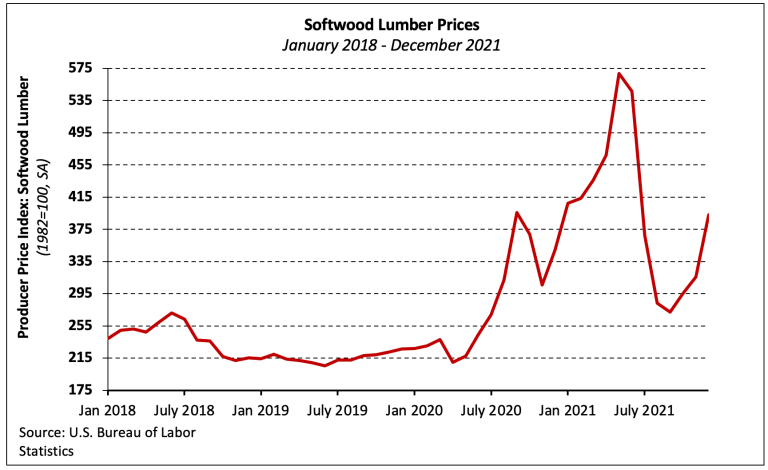

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) increased 24.4% in December and has gained 44.5% since September. According to Random Lengths data, the “mill price” of framing lumber has roughly tripled since late August.

The PPI of most durable goods for a given month is largely based on prices paid for goods shipped, not ordered, in the survey month. This can result in lags relative to cash market prices, suggesting another sizable increase in the softwood lumber producer price index may be in the next PPI report.

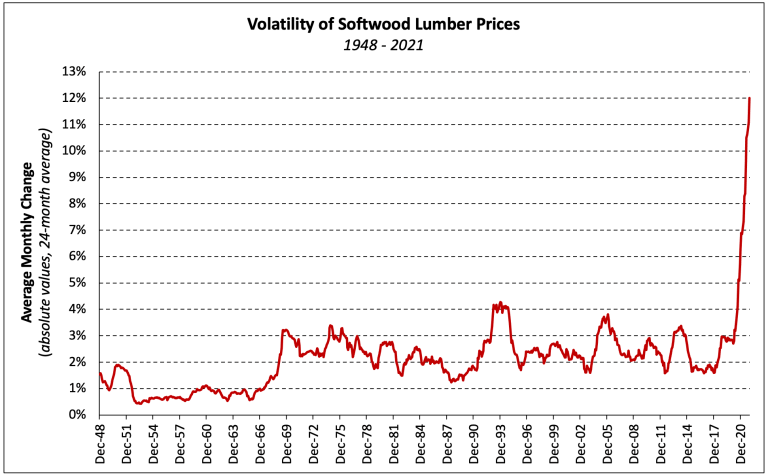

Record-high volatility of softwood lumber prices continues to be as problematic as high prices. The monthly change in softwood lumber prices averaged 0.3% between 1947 and 2019. In contrast, the percent change of the index has averaged 12.0% since January 2020—the highest 24-month average since data first became available 1947 and nearly triple the previous record.

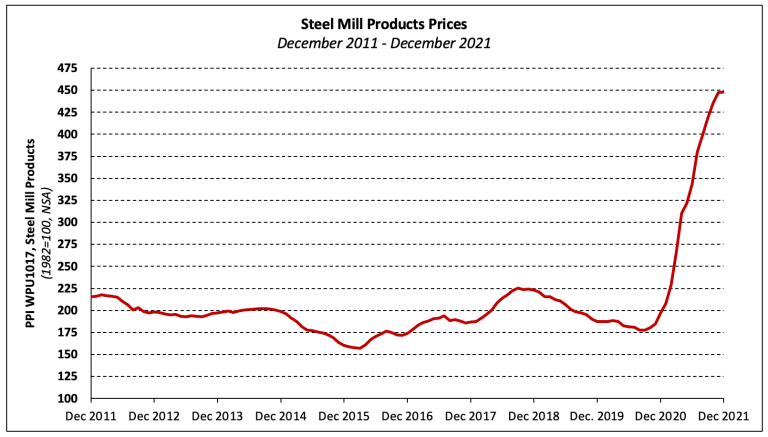

Steel Products

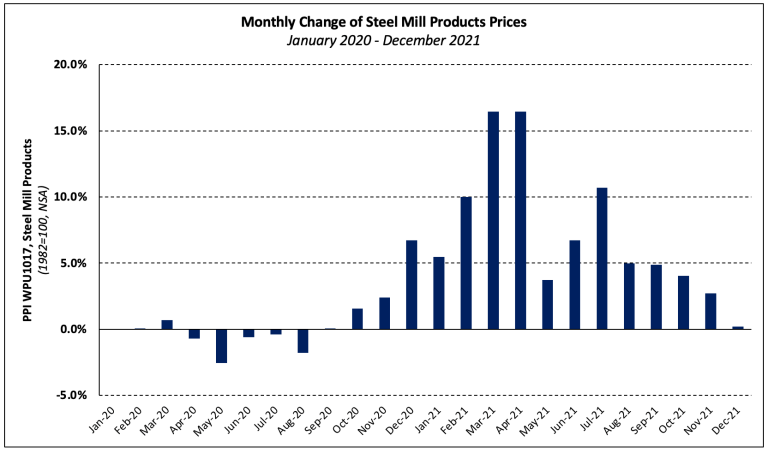

Steel mill products prices rose 0.2% in December, the smallest monthly increase since September 2020. Monthly price increases have slowed in each of the past five months.

The last monthly price decrease in steel mill products occurred in August 2020, and the index has climbed 152.2% in the months since–with more than 80% of that increase taking place in 2021.