Chart: Single-Family Ends 2023 on Strong Note

Originally Published by: NAHB — January 23, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

In a sign that lower mortgage rates continue to boost the housing market, single-family production surpassed the million mark for the second straight month in December.

According to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau overall housing starts fell 4.3% in December. The seasonally adjusted annual rate was 1.46 million units following an unusually strong reading the month before.

The December reading of 1.46 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 8.6% to a 1.03 million seasonally adjusted annual rate but are up 15.8% compared to a year ago. The three-month moving average (a useful gauge given recent volatility) is up to over 1.0 million starts, as charted below.

The multifamily sector, which includes for-rent apartment buildings and condos, increased 8.0% to an annualized 433,000 pace for 2+ unit construction in December. The three-month moving average for multifamily construction has been trending up to a 412,000-unit annual rate. On a year-over-year basis, multifamily construction is down 7.9%.

Total housing starts for 2023 were 1.41 million, a 9.0% decline from the 1.55 million total from 2022. Single-family starts in 2023 totaled 945,000, down 6.0% from the previous year. Multifamily starts in 2023 totaled 469,000, down 14.4% compared to the previous year.

On a regional and year-to-year basis, combined single-family and multifamily starts are 20.1% lower in the Northeast, 10.7% lower in the Midwest, 5.5% lower in the South, and 11.6% lower in the West.

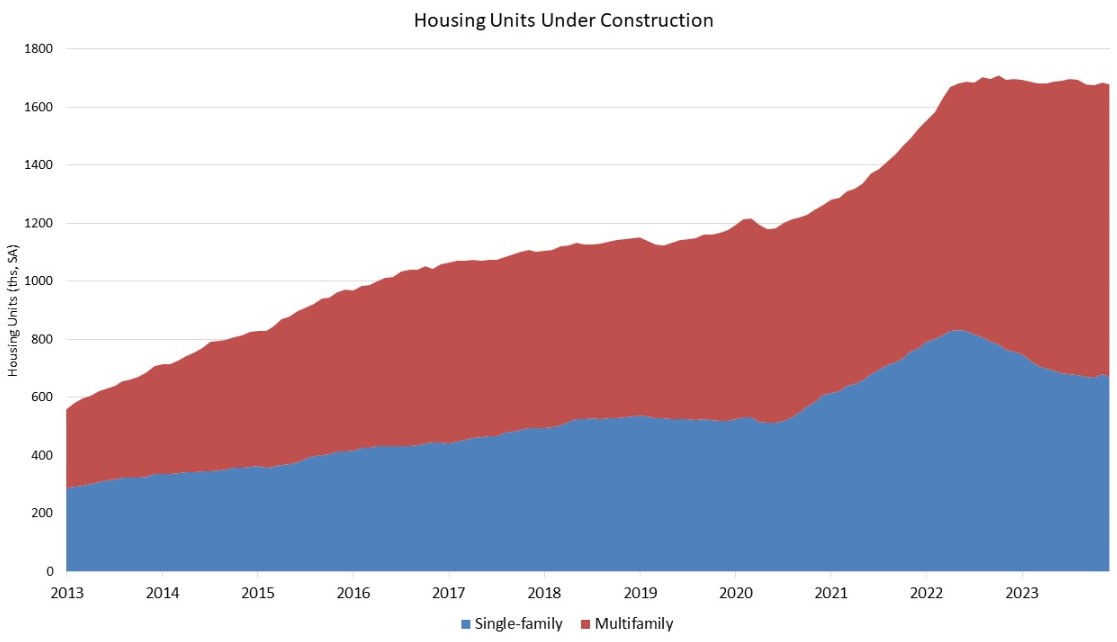

As an indicator of the economic impact of housing, there are now 671,000 single-family homes under construction; This is 11.4% lower than a year ago. Meanwhile, there are currently over 1.0 million apartments under construction. This is up 7.3% compared to a year ago (939,000). Total housing units now under construction (single-family and multifamily combined) are 1.0% lower than a year ago.

Overall permits increased 1.9% to a 1.50-million-unit annualized rate in December and are up 6.1% compared to December 2022. Single-family permits increased 1.7% to a 994,000-unit rate. Single-family permits are also up 1.7% compared to the previous month and up 32.9% compared to the previous year. Multifamily permits increased 2.2% to an annualized 501,000 pace but multifamily permits are down 24.2% compared to December 2022, which is a sign of future apartment construction slowing.

Looking at regional permit data on a year-to-year basis, permits are 21.3% lower in the Northeast, 14.1% lower in the Midwest, 9.4% lower in the South, and 12.2% lower in the West.