Chart: Single-Family Housing Starts Continue Cooling

Originally Published by: NAHB — November 17, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Elevated mortgage rates, high construction costs for concrete and other building materials, and weakening demand stemming from deteriorating affordability conditions continue to act as a drag on single-family housing production.

Overall housing starts decreased 4.2% to a seasonally adjusted annual rate of 1.43 million units in October, according to data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

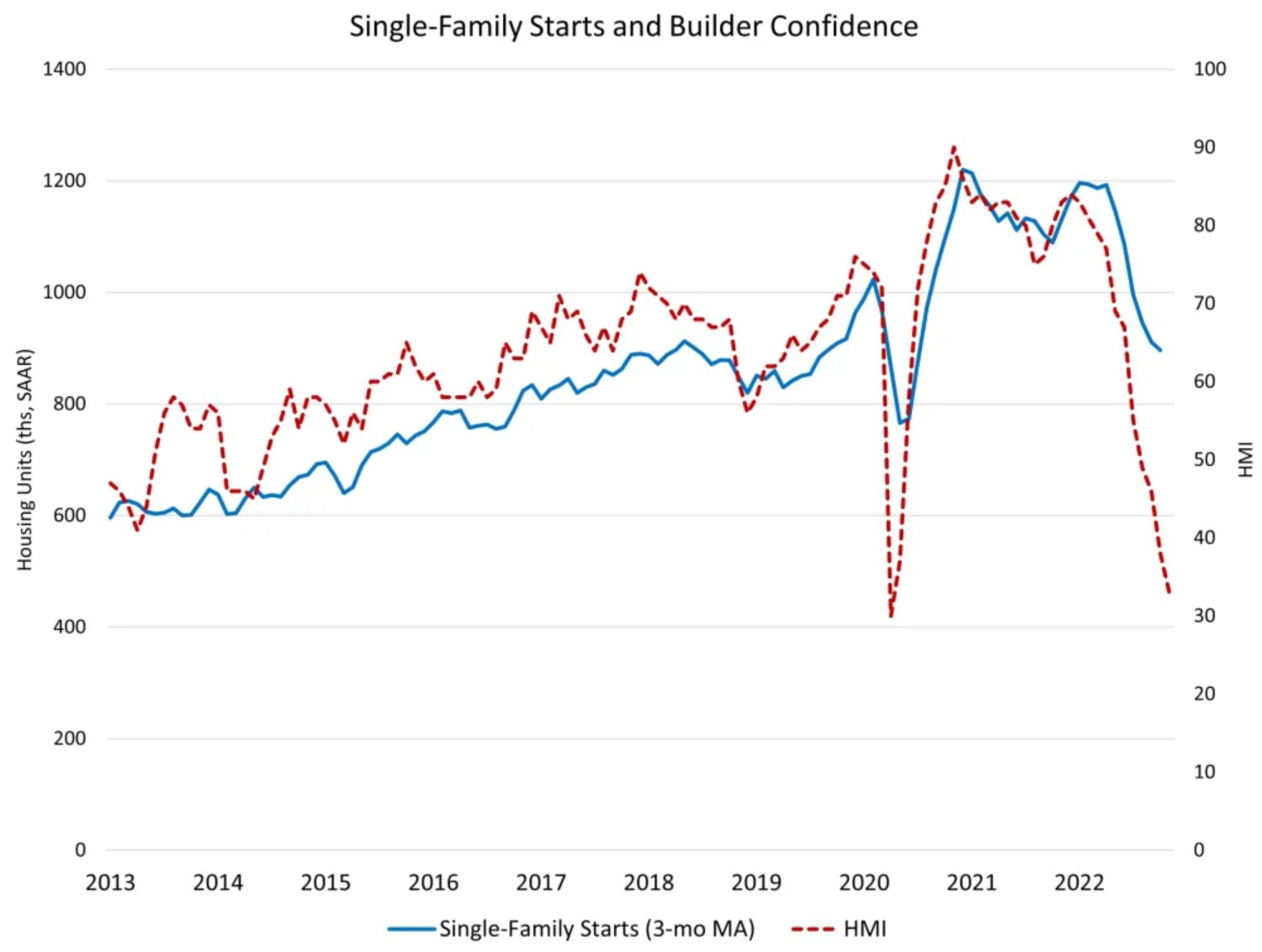

The October reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 6.1% to an 855,000 seasonally adjusted annual rate. Year-to-date, single-family starts are down 7.1%. This decline mirrors the decline in the NAHB/Wells Fargo HMI, which has now contracted for 11 straight months and fallen to a level of 33. Higher interest rates in particular have reduced buyer traffic and priced out demand from the market.

This will be the first year since 2011 to post a calendar year decline for single-family starts. We are forecasting additional declines for single-family construction in 2023, which means economic slowing will expand from the residential construction market into the rest of the economy. Home prices are now falling, and there has not been a period in recent decades during which homes prices have declined and a recession has not occurred.

The multifamily sector, which includes apartment buildings and condos, decreased 1.2% to an annualized 570,000 pace but continues at a strong, likely too strong, pace. Multifamily starts will decline in 2023 as the effects of tighter financing and a rising unemployment rate takes hold.

On a regional and year-to-date basis, combined single-family and multifamily starts are 2.9% higher in the Northeast, 1.5% lower in the Midwest, 2.6% higher in the South and 5.1% lower in the West.

Overall permits decreased 2.4% to a 1.53 million unit annualized rate in October. Single-family permits decreased 3.6% to an 839,000 unit rate. Multifamily permits decreased 1% to an annualized 687,000 pace. Looking at regional permit data on a year-to-date basis, permits are 2.8% lower in the Northeast, 0.2% higher in the Midwest, 1.1% higher in the South and 4.0% lower in the West.

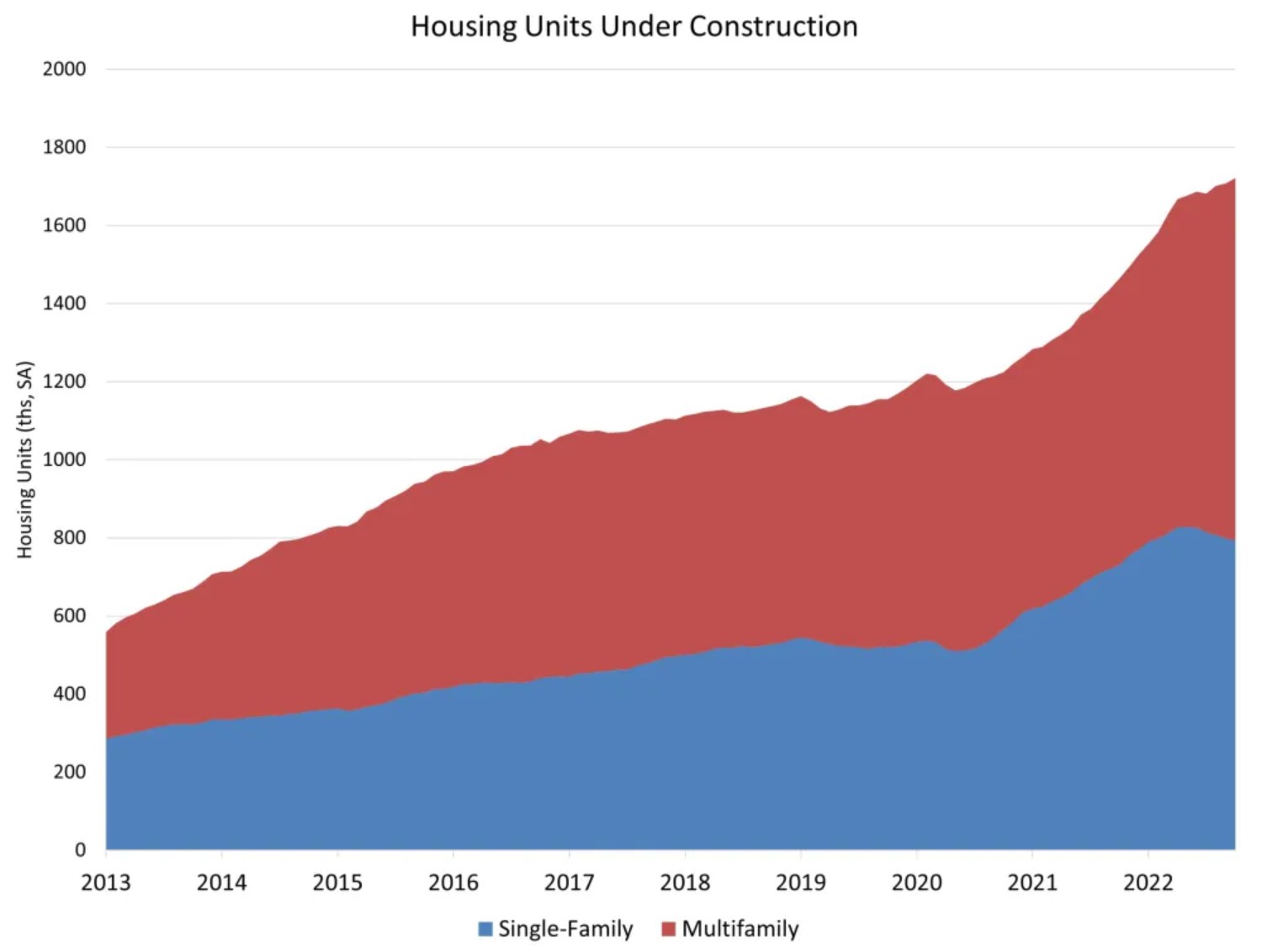

As an indicator of the economic impact of housing, there are now 794,000 single-family homes under construction. This is 9% higher than a year ago. However, the count of such homes is down from 828,000 in May, off 4% as starts slow. There are currently 928,000 apartments under construction (2+ unit properties), up 26% from a year ago with this number continuing to rise. Strikingly, this total is the highest level since December 1973. This volume will place downward pressure on multifamily starts in 2023.

Total housing units now under construction (single-family and multifamily combined) is 18% higher than a year ago. The number of single-family units in the construction pipeline is falling and will continue to decline in the months ahead given recent declines in buyer traffic and higher interest rates.