Charts: Builders Identify Their Top Challenges in 2023

Originally Published by: NAHB — January 24, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

According to the January 2024 survey for the NAHB/Wells Fargo Housing Market Index, high interest rates were a significant issue for 90% of builders in 2023, and 77% expect them to be a problem in 2024. The second most widespread problem in 2023 was rising inflation in US Economy, cited by 83% of builders, with 52% expecting it to be a problem in 2024.

The cost and availability of labor was a significant problem to only 13% of builders in 2011. That share has increased significantly over the years, peaking at 87% in 2019. Fewer builders reported this problem in 2020 (65%), but the share rose again in 2021 (82%) and 2022 (85%). The share eased slightly in 2023 to 74%. A similar 75% expect the cost and availability of labor to remain a significant issue in 2024.

In 2011, building materials prices was a significant problem to 33% of builders. The share has fluctuated over the years, from a low of 42% in 2015 to a peak of 96% in 2020, 2021, and 2022. The slowdown in single-family construction in 2023 made this less of a problem for builders last year, as ‘only’ 63% reported it as a significant issue. Fewer expect it to face it in 2024 (58%).

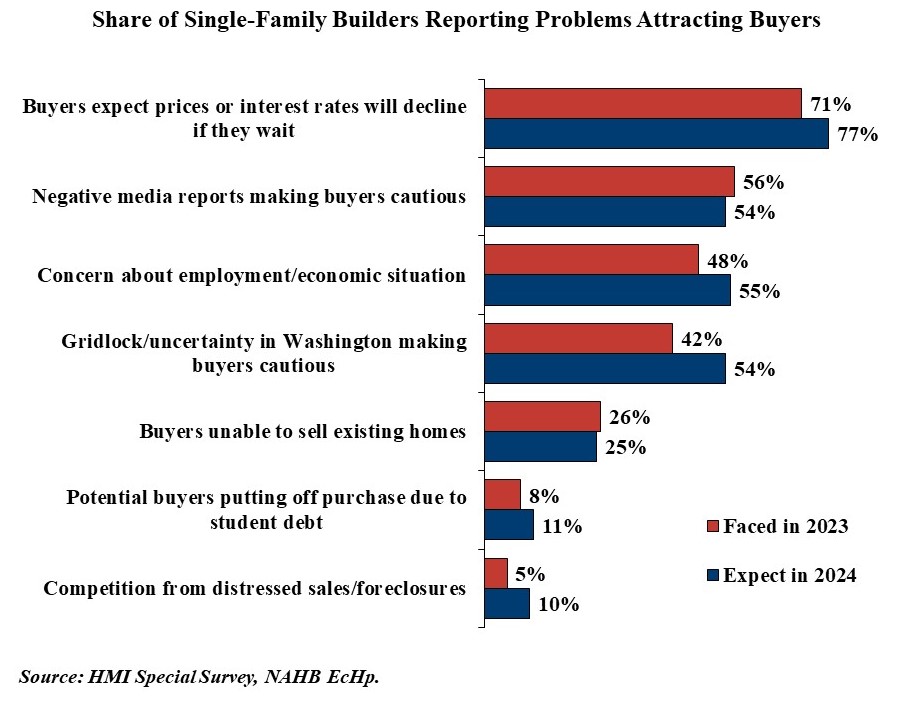

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2024. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 71% of builders in 2023, with 77% expecting it to be an issue in 2024. Negative media reports making buyers cautious was reported as a significant issue by 56% of builders in 2023, and 54% expect this problem in 2024. Concern about employment/economic situation was another buyer issue for 48% of builders in 2023, but 55% anticipate this issue in 2024. Gridlock/uncertainty in Washington making buyers cautious was a significant problem for 42% of builders in 2023, but a larger 54% expect it to be a problem in 2024. Less than 30% of builders experienced problems in 2023 with buyers being unable to sell existing homes, potential buyers putting off purchase due to student debt, and competition from distressed sales/foreclosures.

For additional details, including a complete history for each reported and expected problem listed in the survey, please consult the full survey report.