Charts: Multi-Family Activity Remains Near Record Highs

Originally Published by: NAHB — November 28, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

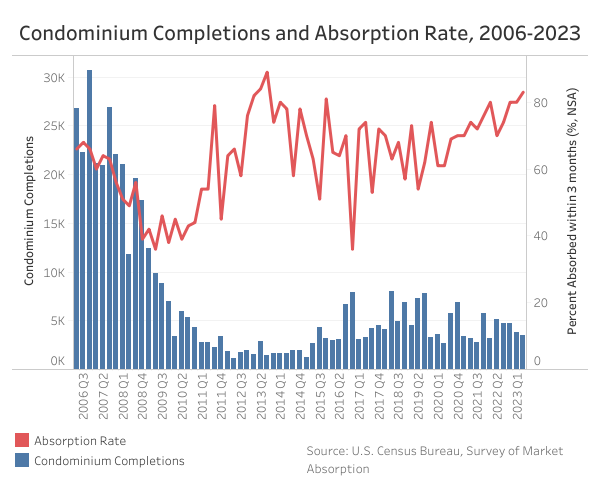

The most recent release of the Census Bureaus’ Survey of Market Absorption of New Multifamily Units (SOMA) reported that of the 99,290 unfurnished, unsubsidized apartments completed in the second quarter of 2023, 65% were absorbed into the market in the first three months following completion. 83% of 3,467 condominiums completed in the second quarter were absorbed within the first three months following completion.

With over an estimated one million multifamily units currently under construction, the level of completed apartments rose to its highest level in the second quarter of 2023 according to SOMA. The number of completions in the second quarter was at 99,290, which is 29.6% higher than the second quarter of 2022 and 19.6% higher than the first quarter of 2023.

The percent of apartments absorbed within three months following completion, was at a non-seasonally adjusted rate of 65%, higher than the 2023 first quarter absorption rate by eight percentage points while seven percentage points less than the second quarter of 2022. As the absorption rate is non-seasonally adjusted, the absorption rate likely seasonally peaked for apartments during the second quarter.

Looking ahead, apartment completions will continue to set record highs as a new units roll out onto the market. This will help slow rent growth, which has been a significant contributor to inflation. The rent data reported from SOMA shows two consecutive quarters of asking rent declines for newly completed apartments, with $1,763 being the median asking rent in the second quarter of 2023.

Condominiums completed in the second quarter of 2023 stood at 3,467, which is 32.6% lower than the number of condos completed in the second quarter of 2022. The percent of these condo purchases within three months following completion stood at 83%, the third consecutive quarter where newly completed condos were absorbed into the market at a rate of 80%. The listed sales price of new condos was at a median of $532,200 in the second quarter, down 26.7% from one year ago.