Construction Backlog Sees Positive Trends Amid Rate Cuts

Originally Published by: Construction Dive — October 17, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Dive Brief:

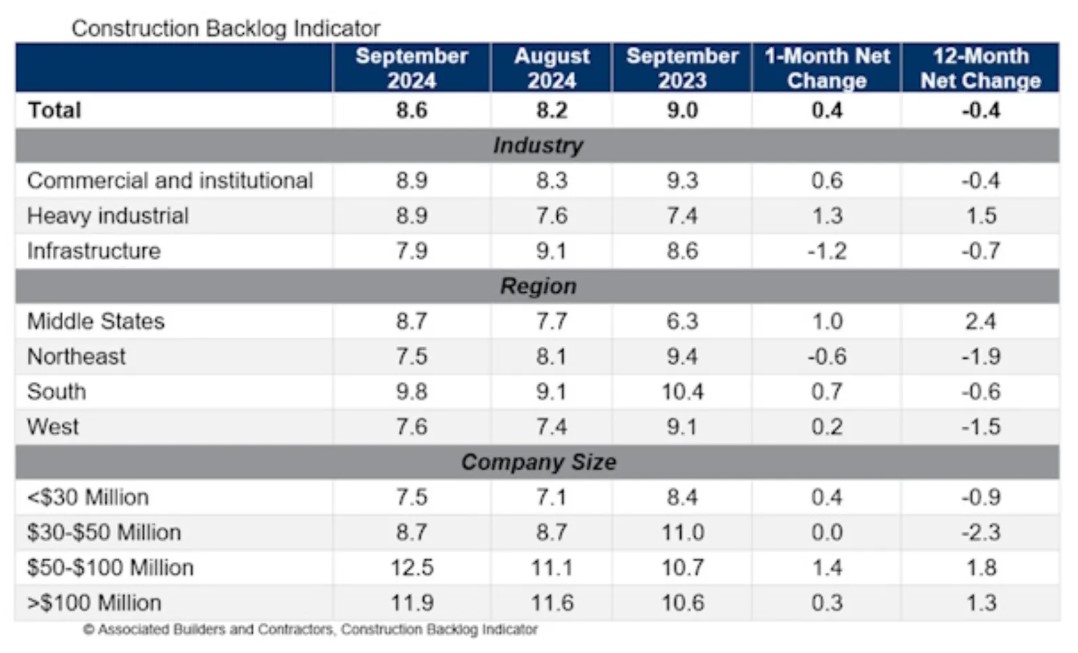

- What a difference a half-point rate cut makes. Thanks in part to the Federal Reserve’s lowering of the interest rate, construction backlog rebounded in September after slumping at the end of the summer, according to an Oct. 15 analysis of recent government data from Associated Builders and Contractors.

- The amount of work in builders’ pipelines bounced back to 8.6 months of runway, after falling to 8.2 in August, boosting confidence in the sector as well. Backlog increased in every region in September, except for the Northeast. That said, most areas are still down for the year, with only the middle states posting a bigger backlog than a year ago.

- “Contractors are back to expecting modest expansion in their margins as of September,” said Anirban Basu, ABC’s chief economist, in a news release. “This optimism likely reflects falling interest rates, which will eventually serve as a tailwind for the industry, and the fact that materials prices have actually declined over the past year.”

Dive Insight:

The positive momentum was across the board by company size, with firms making less than $30 million a year adding more work at a similar pace to those posting $100 million or more in revenue. While contractors in the $30 million to $50 million range stayed even, there were no declines.

Despite that positive bounce in both work and contractors’ outlooks, Basu noted that contractor confidence and backlog are lower than a year ago, suggesting that the effects of high interest rates continue to weigh on the industry.

Courtesy of Associated Builders and Contractors

Still, September’s bounce provides evidence that the sector may be honing in on the much touted “soft landing” that the Federal Reserve was aiming for in keeping interest rates elevated until its cut on Sept. 18.

Before that, contractors’ expectations for profit margins briefly slipped below the threshold of 50, indicating an anticipated contraction in the space. With the latest bump, however, that metric has recovered to 50.9, indicating that contractors see more expansion ahead.