Construction Industry Still Dealing with Elevated Material Costs

Originally Published by: Construction Dive — March 11, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Since 2020, events tend to garner a pre- and post-pandemic label. That’s certainly true in construction.

For example, contractors had once hoped construction prices would return to pre-pandemic levels. Instead, five years after the start of the COVID-19 pandemic, costs have yet to drop back. What’s more, construction pros are bracing for another surge in materials costs due to ongoing and upcoming tariffs.

The virus that left the world indelibly changed continues to impact the building industry as the calendar turns to March 11, the date in 2020 that the World Health Organization declared COVID a global pandemic. The U.S. issued its own national emergency on March 13, with states instituting lockdown orders soon after.

“In the beginning, we thought the shutdown would only last a few months. And once people started returning to in-person work, we thought it would take a few months for manufacturers to staff up and work through the backlogs,” said Les Hiscoe, CEO of Shawmut Design and Construction, a Boston-based general contractor. “We weren’t anticipating the long-term disruption and reduction in the labor force, resulting in continued impacts to the supply chain.”

Les Hiscoe

Permission granted by Shawmut

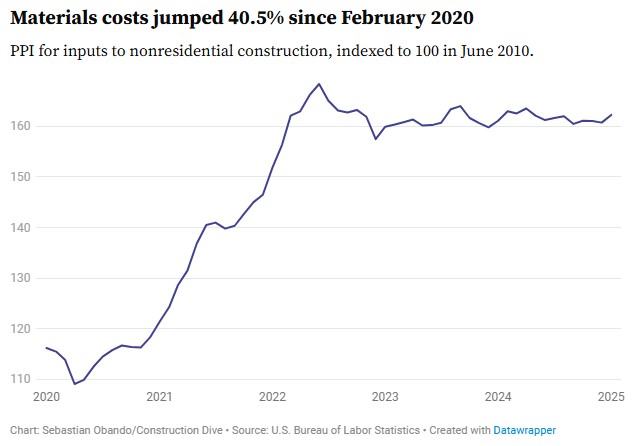

Hiscoe wasn’t alone in that thinking. After prices for essential materials such as iron, steel, brick and switchgear skyrocketed in 2020 and 2021 — peaking in June 2022 at 46.4% above February 2020 levels — many contractors expected a gradual return to pre-pandemic levels, said Sharon Wilson Géno, president of the National Multifamily Housing Council, during a Marcus & Millichap economic and construction real estate outlook webinar earlier this year.

But what went up hasn’t really come down.

“There was an expectation post-COVID that construction costs would come down somewhere around prior levels, but that really hasn’t happened,” said Wilson Géno. “While we haven’t seen the volatility in construction pricing that we saw during COVID, it has flatlined by and large in most markets, but it’s flatlined at a much higher level.”

Inputs to nonresidential construction now sit about 40.5% higher than February 2020, according to the Producer Price Index. Much of that increase occurred in the years immediately following the pandemic’s onset. Since 2022, costs have largely hovered around the same level.

“Supply chain conditions have improved, with many providers reporting greater availability and shorter wait times,” said Rob Mineo, managing director at FMI Capital Advisors, a Raleigh, North Carolina-based investment firm. “However, while the situation has normalized to an extent, there is no definitive metric to confirm a full return to pre-pandemic conditions. Many operators continue to place equipment orders well in advance as a precautionary measure against potential future disruptions.”

“Supply chain conditions have improved, with many providers reporting greater availability and shorter wait times,” said Rob Mineo, managing director at FMI Capital Advisors, a Raleigh, North Carolina-based investment firm. “However, while the situation has normalized to an extent, there is no definitive metric to confirm a full return to pre-pandemic conditions. Many operators continue to place equipment orders well in advance as a precautionary measure against potential future disruptions.”

Supply chain shuffle

Before COVID, the construction industry relied heavily on global manufacturers for building materials, said Dave Steffenhagen, project executive at McHugh Construction, a Chicago-based general contractor. In response to pandemic-induced supply chain disruptions, firms such as McHugh have developed more relationships with domestic and North American material suppliers.

Dave Steffenhagen

Permission granted by McHugh Construction

“No one knew how long the material supply chain delays would last. It was an uncertain time that no one was prepared for,” said Steffenhagen. “Now, we’re able to provide our clients multiple recommendations for equivalent alternatives to overseas-sourced products.”

Along with turning to manufacturers closer to home, federal spending also played a supporting role in supply chains’ stabilization, said Mineo. Prices, which had been climbing at a rapid rate, eventually settled. Lead times for certain materials, such as asphalt, even improved after 2022, fueling optimism that construction costs would gradually trend lower, said Mineo.

But that optimism has faded. By 2023 and 2024, construction prices plateaued at still-high levels, showing little sign of a meaningful drop. Now, three months into 2025 and five years after calamity struck, contractors are accepting a new reality.

Prices aren’t just staying high, they’re climbing again.

Tariff impacts

On March 4, President Donald Trump imposed a 25% tariff on goods from Mexico and most of Canada, along with an additional 10% tariff on Chinese products. The Trump administration on March 6 suspended these tariffs on all imports that are compliant with the United States-Mexico-Canada Agreement until April 2.

But on March 12, nearly five years to the day that COVID was declared a pandemic, the Trump administration plans to enact a 25% tariff on all steel and aluminum imports worldwide, as well as a 50% tariff on Canadian metals.

Though these measures have yet to stick permanently, just the threat of them has already taken a toll on the construction industry. Prices surged in January as contractors rushed to buy materials before potential deadlines.

The new tariffs will “do some damage,” said Mark Zandi, chief economist at Moody’s Analytics, during the Marcus & Millichap event.

The U.S. relies heavily on imports for lumber, steel and cement, making these materials especially vulnerable to price hikes, said Brandon Michalski, construction economist at MOCA Systems, a Boston-based construction consultant. In fact, Michalski forecasts a 2.4% year-over-year cost increase for construction materials in 2025, following a decline of just under 1% in 2024.

In other words, while nearshoring has put contractors on firmer ground than before COVID, the changes still haven’t made U.S. builders material independent.

“There is risk baked into this outlook from increases related to tariffs,” said Michalski. “U.S. reliance on imports for lumber, steel and cement products may significantly impact the cost of construction in 2025.”

The impact could be particularly severe in cement and aggregates, said Mineo.

“U.S. cement consumption has outpaced domestic production in recent years, leading to a significant increase in imports,” said Mineo. “With domestic production already at capacity, higher import costs would naturally drive up domestic prices as well, as producers would have little incentive to keep prices low.”

For aggregates, prices are expected to continue rising steadily but not at a surge-level pace, said Mineo. Most aggregate production in the U.S. is domestic, though some regions that rely on imports from Canada and Mexico will be impacted, he added.

Margins tighten, but no slowdown

The news comes at a time when contractor profit margins are already tightening, according to an Associated Builders and Contractors survey. Higher material costs, combined with lingering labor shortages, have put additional strain on budgets.

“Barring a black swan event, it’s unlikely that construction costs will see meaningful declines in 2025,” said Michalski.

Yet, shovels continue to hit dirt within certain sectors.

The Project Stress Index, which tracks delayed and abandoned projects, along with construction starts data, indicate certain segments are holding steady despite higher costs. That suggests developers are finding ways to move forward despite the expensive landscape, said Wilson Géno.

Sharon Wilson Géno

Courtesy of National Multifamily Housing Council

“There is some anecdotal evidence that some deals are starting to move forward,” said Wilson Géno. “Those deals have just adjusted to the new environment and figured out that, because demand continues, that they might as well find a way at a higher cost.”

Michalski echoed that sentiment, adding that while some projects will be delayed or scaled back, most developments are adjusting to a permanently higher cost environment. Data centers, for example, accounted for more than 75% of construction spending’s monthly gain in January, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data.

“While some projects may be pushed or canceled, most are expected to continue as companies adapt through value engineering and strategic planning,” said Michalski. “The industry remains resilient despite these challenges.”

Now, as the construction industry works to build through its fifth year since the beginning of lockdowns, supply-chain snarls and material scarcity, builders are preparing for a sense of deja vu all over again.

“Inventory management has permanently changed — we are now operating in the new standard,” said Hiscoe. “Project set-up time continues to be much longer than pre-pandemic days, so partnership and upfront collaboration with clients, architects and engineers is imperative.”