For Sellers, it’s Important to Understand a Waterfall Scenario

Originally Published by: LBM Journal — December 1, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Let’s say you successfully found a buyer for your company, and you are wrapping up the due diligence process as the final stage before your deal proceeds. As the deal moves towards closing, you the seller may want to see a “waterfall scenario,” showing where money is allocated at the closing. A waterfall is an expression (on a spreadsheet) that itemizes payments, escrows, or share allocations that are distributed (or laid claim to) by the various parties involved in the transaction in a hypothetical closing. The waterfall shows where—and approximately how much—funds or deal proceeds will be paid and to whom. The final numbers for a deal are hard to calculate to the penny in a waterfall, since various accruals need to be trued-up on closing day. So, the waterfall is really an estimate, as close as can be determined with the data at hand.

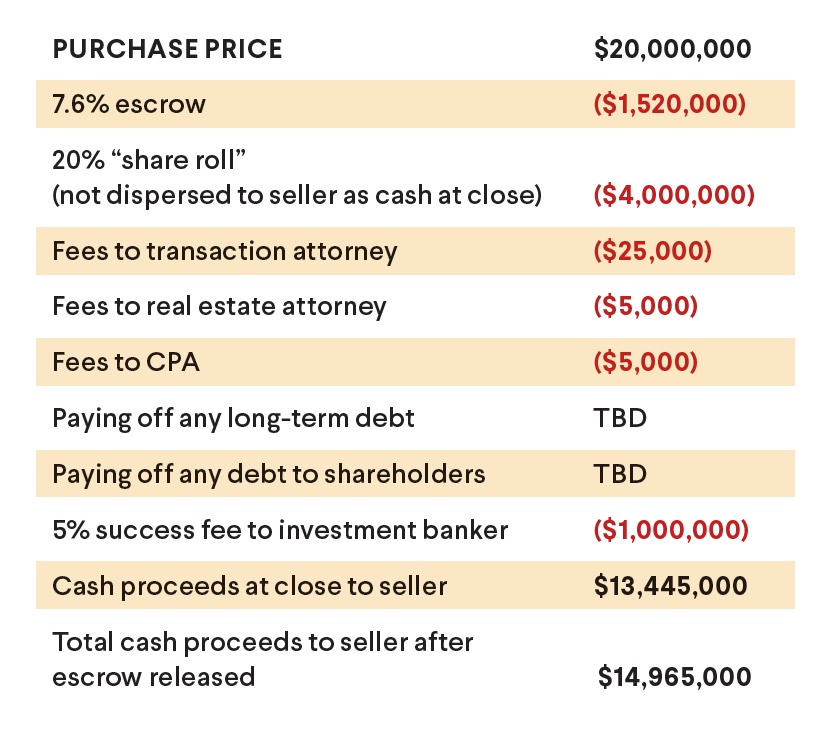

Let’s assume a $20 million purchase price and look at who gets paid at the closing. First, let’s clear up a common misperception. When you sell your company for $20 million, you won’t get $20 million at the closing, even if the buyer is offering “all-cash-at-close.” That’s because all buyers will require an escrow. This protects them, post-close, for unseen liabilities, such as an unexpected lawsuit that pops up. GF Data tracks the escrow amounts for deals of all sizes, and for deals valued at up to $25 million, a typical escrow is 7.6% of the deal value; the money may be held for up to 16 months. A $20 million deal means a $1,520,000 escrow. Your $20 million just went to $18,480,000 at close.

In deals that are not all-cash, it’s common for buyers to ask for sellers to take shares in the NewCo created by the acquisition (or the NewCo you are joining upon acquisition). Many buyers ask for 20% of the deal value in a “share roll.” Take 20% of $20 million, and the $20 million is reduced by another $4 million. (Note: You are often not required to accept share rolls, so don’t assume it’s mandatory in your deal.) After the escrow and share roll are deducted from the $20 million purchase price (and we’re assuming there’s no earn-out or seller’s note in our example), there are other charges to settle at closing, and these are part of the waterfall. Specifically, the long-term debt needs to be paid off, as well as any debt to shareholders. Then, various service providers need to get paid at the closing too. These include the fees paid for any CPA services associated with the sale (assume $5k) and the fees paid to any real estate attorneys that work on the real estate leases (assume $5k). There will also be fees owed to the transaction attorney you retained (assume $25k) to work through the documentation of your deal (e.g. review of the LOI, the purchase agreement, the disclosure schedules, etc.). Finally, there is the fee paid to your investment banker (5% of the deal value is typical) whose tireless efforts prepared your company for sale, found the buyer, and helped sustain the appropriate momentum to get the deal over the line…and closed.

In a deal involving the fees cited above, the waterfall would look like the one below.

Ask your investment banker to generate the waterfall scenario. With it, you’ll have a clear understanding of how deal proceeds are distributed and to whom; all funds are paid by wire. Then, after you see the allocation of funds, you’ll have more time to focus on the taxes!