Multifamily Construction Moderating in Q2 2022

Originally Published by: NAHB — August 18, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

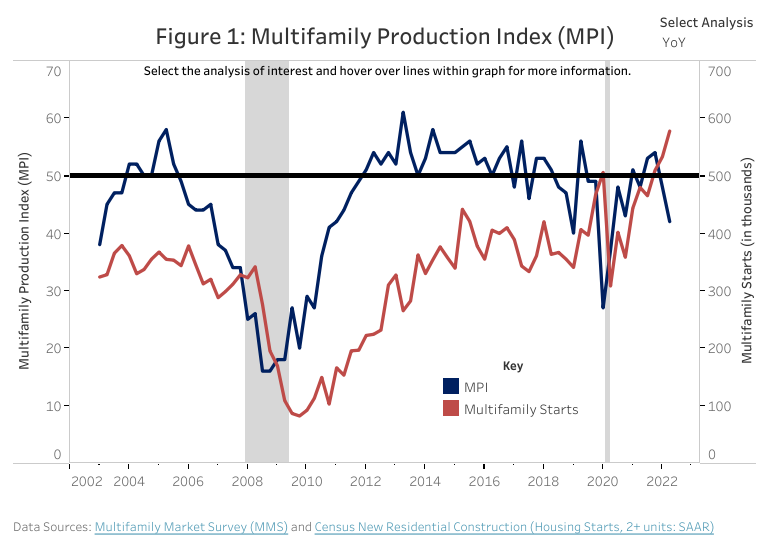

Confidence in the market for new multifamily housing was mixed in the second quarter of 2022, according to results from the Multifamily Market Survey (MMS) released today by the National Association of Home Builders (NAHB). The MMS produces two separate indices. The Multifamily Production Index (MPI) decreased 6 points to 42 compared to the previous quarter, dragged down largely by the for-sale condo sector. The Multifamily Occupancy Index (MOI) fell 8 points to 60.

The MPI is a weighted average of three key elements of the multifamily housing market: construction of low-rent units-apartments that are supported by low-income tax credits or other government subsidy programs; market-rate rental units-apartments that are built to be rented at the price the market will hold; and for-sale units—condominiums. Two of the three components saw decreases compared to the first quarter: the component measuring low-rent units fell 4 points to 45, and the component measuring for-sale units declined 11 points to 33. Meanwhile, the component measuring market rate apartments increased by 3 points to 52.

The MOI measures the multifamily housing industry’s perception of occupancies in existing apartments. It is a weighted average of current occupancy indexes for class A, B, and C multifamily units, and can vary from 0 to 100, with a break-even point at 50, where higher numbers indicate increased occupancy. The MOI fell 8 points to 60, but multifamily developers on balance are still reporting improving occupancy.

Results for the MOI’s components weakened from the previous quarter, although all three remained above 50. The index for occupancy in class A apartments declined 9 points to 59, the index for class B decelerated 8 points to 61, and the index for class C apartments decreased 5 points to 60.

The multifamily market is still showing signs of resiliency as overall starts experience a double-digit increase and all regions record positive growth in the number of permits issued year-to-date for 2022. However, as mortgage rates continue to rise due to the Federal Reserve’s current monetary policy stance and higher construction costs, multifamily developers will need to be cautious given recession concerns moving forward.

For complete results from the Multifamily Market Survey, including the history of each index and its components back to the survey’s inception in 2003, please visit NAHB’s MMS web page.