Multifamily Demand Strengthens Further

Originally Published by: NAHB — August 24, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

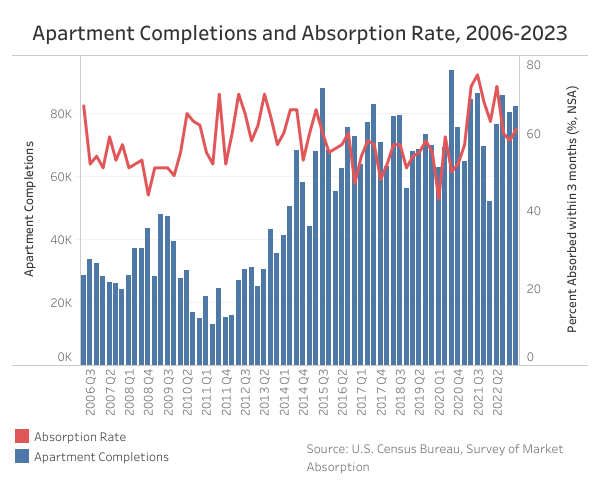

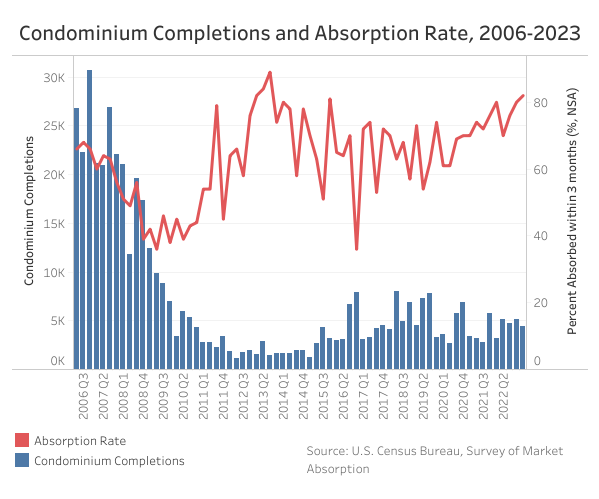

Data from the Census Bureau’s latest Survey of Market Absorptions of New Multifamily Units (SOMA) indicates that demand for newly completed multifamily units remains solid as mortgage rates continue to climb. Only an estimated 39% of the 82,310 unfurnished apartment units completed in the first quarter of 2023 are available for rent three months past construction completion. For condominiums, an estimated 792 units remain available after 4,398 were completed in the first quarter of 2023.

The absorption rate of unfurnished, unsubsidized apartments (the share rented out in the first three months following completion) rose three percentage points to 61.0% in the first quarter of 2023. The number of completions was up from the fourth quarter of 2022, from 80,200 to 82,310, while completions were up 58.2% from one year ago. Completions a year ago were at their lowest level since 2015 but the multifamily market rebounded strongly over the following year and has completed over 75,000 apartments for four consecutive quarters. The absorption rate of new apartments consequently fell with historic levels of completions hitting the market during this time.

The condominium absorption rate (the share purchased in the first three months following completion) increased from the fourth quarter of 2022 by two percentage points to 82.0% while condominium completions increased by 39.8% on a year-over-year basis from 3,169 in the first quarter of 2022 to 4,398 in the first quarter of 2023.

The median asking rent for unfurnished apartments fell 2.0% from the fourth quarter of 2022 to $1,837. This is also $15 lower than one year ago when median asking rent was at $1,852. Additionally, this marks the first YoY decline in the median asking rent of new apartments since the fourth quarter of 2020. Newly complete condominiums median asking price fell in the first quarter of 2023 from $763,500 to $511,500, a 33.0% quarterly decline. From one year ago, condominium prices are 19.6% lower, the third consecutive year-over-year decrease in new condominiums asking price.