Multifamily Developer Confidence Reflected Mixed Results in the Fourth Quarter

Originally Published by: NAHB — February 13, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

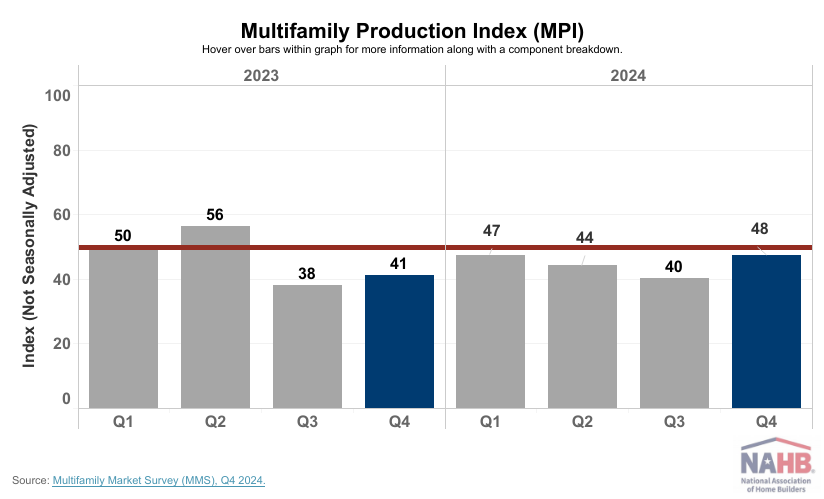

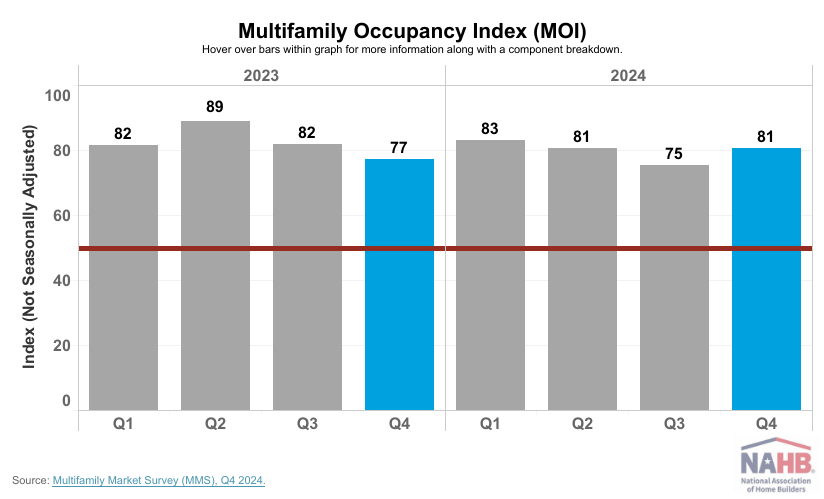

Confidence in the market for new multifamily housing reflected mixed results year-over-year in the fourth quarter, according to results from the Multifamily Market Survey (MMS) released today by the National Association of Home Builders (NAHB). The MMS produces two separate indices. While the Multifamily Production Index (MPI) increased seven points to 48 year-over-year, it is still below the break-even point of 50. The Multifamily Occupancy Index (MOI) had a reading of 81, up four points year-over-year.

An MPI below 50 is consistent with the decline in multifamily starts that the sector experienced in both 2023 and 2024. Multifamily developers are slightly less pessimistic than they were at this time last year, but supply-chain problems and high interest rates remain serious barriers to a stronger market. NAHB forecasts multifamily construction will decline again in the first half of 2025 before stabilizing toward the end of the year, with the industry supported by a low national unemployment rate.

Reflected by the MOI reading of 81, occupancy rates for owners of rental properties have remained solid even as they are continuing to struggle with high operating costs.

Multifamily Production Index (MPI)

The MPI is a weighted average of four key market segments: three in the built-for-rent market (garden/low-rise, mid/high-rise, and subsidized) and the built-for-sale (or condominium) market. The survey asks multifamily builders to rate the current conditions as “good”, “fair”, or “poor” for multifamily starts in markets where they are active. The index and all its components are scaled so that a number above 50 indicates that more respondents report conditions as good rather than poor.

Three of the four components experienced year-over-year increases: the component measuring mid/high-rise units rose 13 points to 39, subsidized units increased 11 points to 52, and garden/low-rise units added one point 52. The only component to experience a decline year-over-year was built-for-sale units, falling one point to 42. However, only two MPI components (garden/low-rise and subsidized) were above the break-even point of 50.

Multifamily Occupancy Index (MOI)

The MOI is a weighted average of the three built-for-rent market segments (garden/low-rise, mid/high-rise and subsidized). The survey asks multifamily builders to rate the current conditions for occupancy of existing rental apartments, in markets where they are active, as “good”, “fair”, or “poor”. Similar in nature to the MPI, the index and all its components are scaled so that a number above 50 indicates more respondents report that occupancy is good than report it as poor.

All three components for the MOI experienced year-over-year gains. The component measuring mid/high-rise units rose 10 points to 74, subsidized units increased by three points to 91, and garden/low-rise units added one point to 81. All three MOI components were above the break-even point of 50.

The MMS was re-designed last year to produce results that are easier to interpret and consistent with the proven format of other NAHB industry sentiment surveys. Until there is enough data to seasonally adjust the series, changes in the MMS indices should only be evaluated on a year-over-year basis.

Please visit NAHB’s MMS web page for the full report.