NAHB Census: 2021 Was a Very Good Year for Home Builders

Originally Published by: NAHB — September 30, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

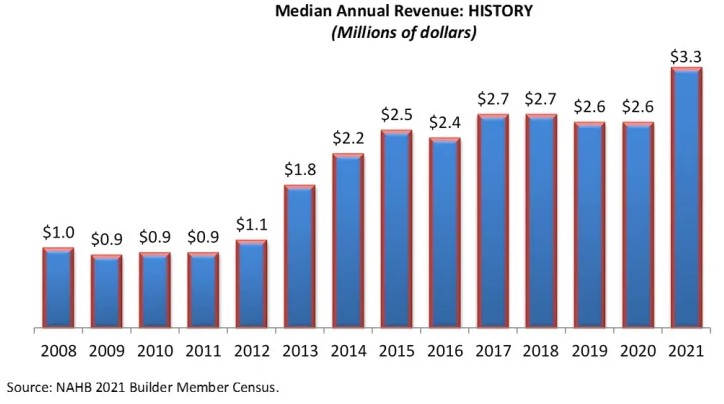

The business of the typical NAHB (National Association of Home Builders) builder grew significantly between 2020 and 2021, according to results from NAHB’s latest member census. The 2021 NAHB census shows that the median gross revenue of an NAHB builder in 2021 was $3.3 million, up 26.9 percent from the previous year.

NAHB reinstated its member census during the industry-wide downturn of 2008, when median annual revenue of builder members was only around $1.0 million. Median annual revenue began rising in 2013, plateauing at $2.6 to $2.7 million from 2017 through 2020. The $3.3 million recorded in 2021 thus represents an all-time high, as well as a substantial 26.9 percent increase from the 2020 number.

Although their median revenue has increased recently, most NAHB builders remain relatively small businesses by conventional standards. In the 2021 NAHB census, 14 percent of NAHB’s builder members reported a dollar volume of less than $500,000, 13 percent reported between $500,000 and $999,999, 38 percent between $1.0 million and $4.9 million, 15 percent between $5.0 million and $9.9 million, 6 percent between $10.0 million and $14.9 million, and 13 percent reported dollar volume of $15.0 million or more. In comparison, the Small Business Administration’s size standards classify most types of construction businesses as small if they have average annual receipts of less than $39.5 million.

The NAHB census also asks builder members about the number of homes started. On average, NAHB builders started an average of 63.1 homes in 2021 (41.6 single-family units and 21.5 multifamily homes). The median number of housing starts was 6. Because the data on starts include a small percentage of very large builders, the average number of starts is much higher than the median, and for many purposes the median number of 6 housing starts is more representative of the typical builder.

The median number of starts increased by an even 20.0 percent, from 5 in 2020 to 6 in 2021. Although the average number of starts is more sensitive than the median to results reported by a relatively small number of large builders, the average can be useful for illustrating industry trends. The trend in average starts per builder has been generally upward over the long term.

Agreeing with the increase in builder revenue, there was a particularly strong surge in the average number of housing starts per builder between 2020 and 2021. The increase was 53.9 percent—from 41.0 in 2020 to 63.1. The average number of single-family starts grew by 58.2 percent (from 26.3 to 41.6), while the average number of multifamily starts increased by 46.3 percent (from 14.7 to 21.5).

Not surprisingly, multifamily builders tend to start more homes per year than single-family builders. NAHB’s multifamily builders reported a median of 84 housing starts in 2021, compared to 6 for single-family builders.

This information was originally published in the August 2022 Special Study available on NAHB’s Housing Economics web page. For more information, including median dollar volume, starts and employment as well as basic demographics for each of the major types of NAHB builder member, please consult the longer special study.