Why Residential Construction in 2023 is Like a DeLorean

Originally Published by: Builder Online — February 16, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

If 2023 were a car, it would be a DeLorean—a beautiful product with lots of flash and some innovative ideas, but also serious issues underneath the hood.

Ray Dalio, the retired CEO of Bridgewater Associates, mused that most people expect the future to be a slightly modified version of the present, but it’s usually very different. For housing suppliers and building products in 2023, I agree—the next three years will look far different than the prior cycles.

Suppliers’ Lives are About to Get More Complicated

From a building products standpoint: I hear some forecasters say “things will normalize” and “mean reversion will occur.”

As if we should assume manufacturing products for the home will get easier and remain so. Rather, my sense is upstream coordination could get harder. For building product manufacturers, we see risks piling up in the second half of 2023. By that time:

- Large remodel backlogs will be worked through (they are already falling);

- The savings glut will have worked mostly through, causing postponement of remodel projects;

- Backlog of new multifamily will have declined meaningfully, and single-family cycle time lift to manufacturers may fall off; and

- Inventories in the channel will still be finding correct equilibrium, causing suppliers to see volatile order patterns (which is hard to produce for).

Do You Realize the Longer-Term Backdrop of Your Suppliers?

There are serious demographic and manufacturing challenges among many of your suppliers, especially those who import. Coordination will get harder, not easier, a year from now.

For those who manufacture domestically, labor availability and productivity is shifting unfavorably, at the same time as their capital costs rise and margins face pressure. Distribution is shifting, and relative pricing power is being renegotiated.

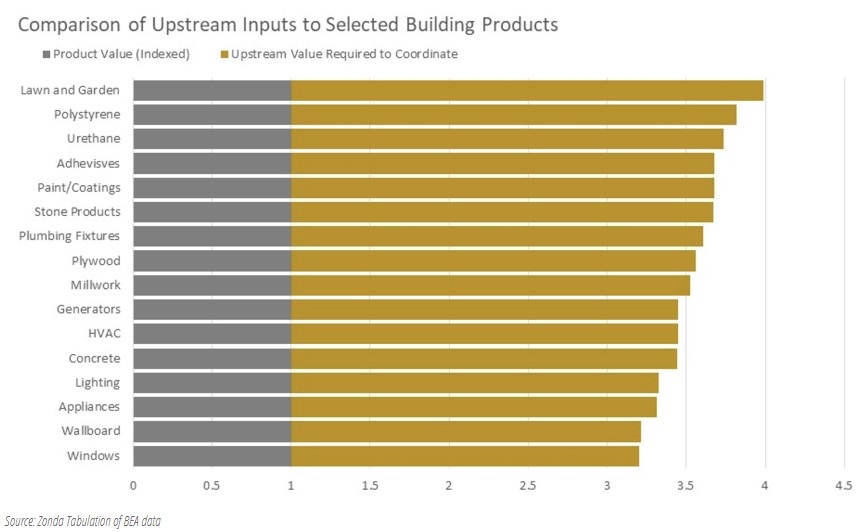

For every dollar of building products installed in the home, we can trace an additional $1.79 of coordinated upstream inputs (from Bureau of Economic Analysis data) that must occur at the right time. Mess with these inputs, and seemingly simple products such as windows become a mismatch of wrong components and unreasonable wait times. Or you pay for the products at the front of the line. We saw this a year after COVID-19.

Learn from Volatility

Volatility is a signal of something important. Input costs have been more volatile in the past 36 months than the prior 70 years cumulatively. The closest periods to what we’ve seen recently were the war periods pre-1950.

Outliers occur all the time, but repeated outliers? That should raise the hair on our necks for scenario planning. Repeated data points that look bizarre (i.e., outliers) should be interpreted as evidence that we are in a different distribution of outcomes. The mean is shifting, which shifts the competitive landscape for housing suppliers. Imagine if you had locked in your lumber supplier in June 2020.

Have we learned nothing? When COVID-19 first emerged, the housing industry initially focused on demand. It would have been wise to focus on locking down suppliers, because upstream disorder took a year to manifest itself.

Prices are relatively lower now, and products are available. But don’t get complacent—disorder (for building products) takes time to manifest, but it hits us over the head when it finally becomes clear.

In the long run, I am quite optimistic about building products. I think 2020 to 2030 will be remembered as the “Golden Age of Remodeling, but with a Recession in the Middle.”

We are in that slowdown now. But when the industry turns, procurement could be more challenging than you think. It’s time to plan ahead. Be deliberate, strategic, and ask the right questions.