Chart: New Home Sales Continue Plunge in June

Originally Published by: NAHB — July 26, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

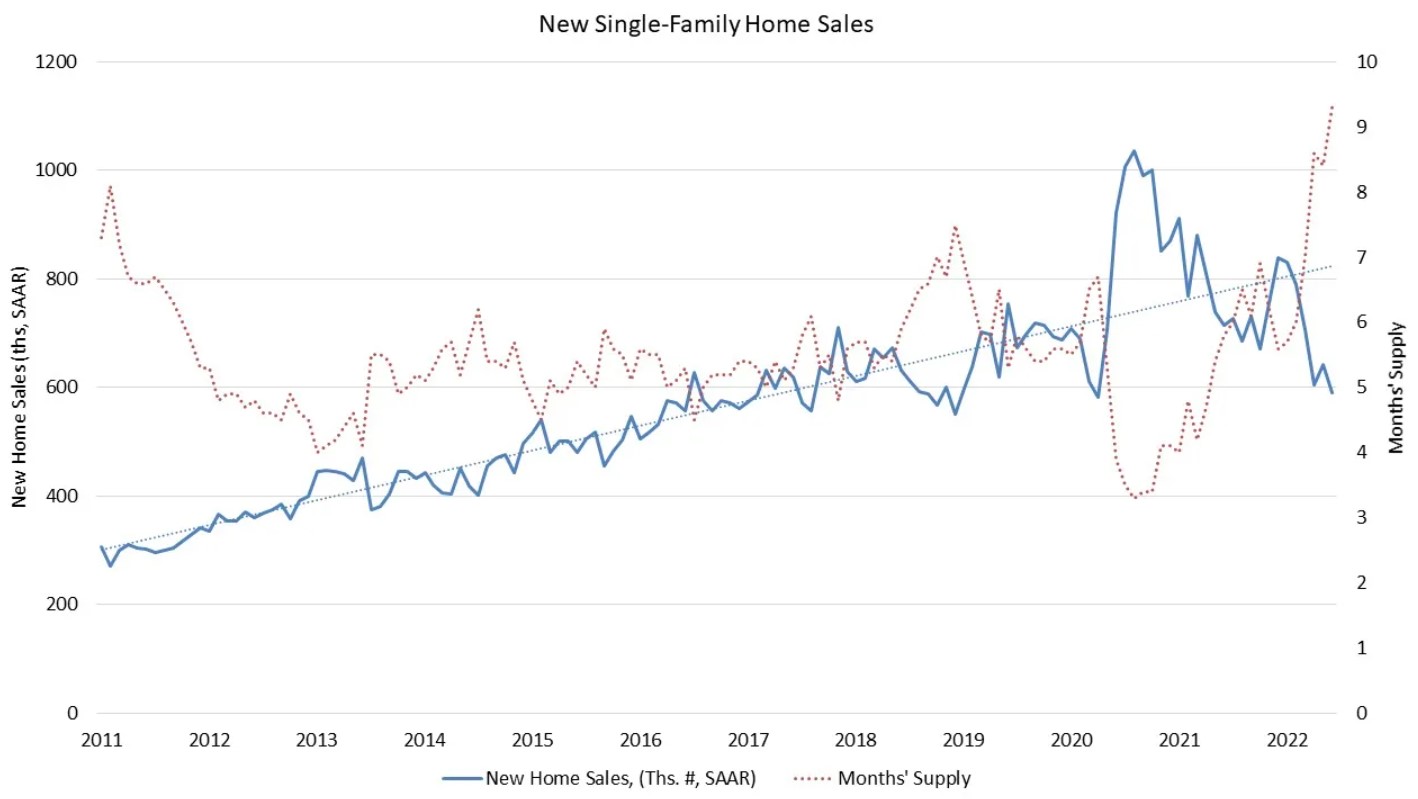

New single-family home sales declined in June due to rising mortgage rates and worsening affordability conditions. Per Freddie Mac, the 30-year fixed rate mortgage was 5.10% at the end of May and climbed to 5.70% by the end of June.

The U.S. Department of Housing and Urban Development and the U.S. Census Bureau estimated sales of newly built, single-family homes in June at a 590,000 seasonally adjusted annual pace, which is a 8.1% decline over the downwardly revised May rate of 642,000 and is 17.4% below the June 2021 estimate of 714,000.

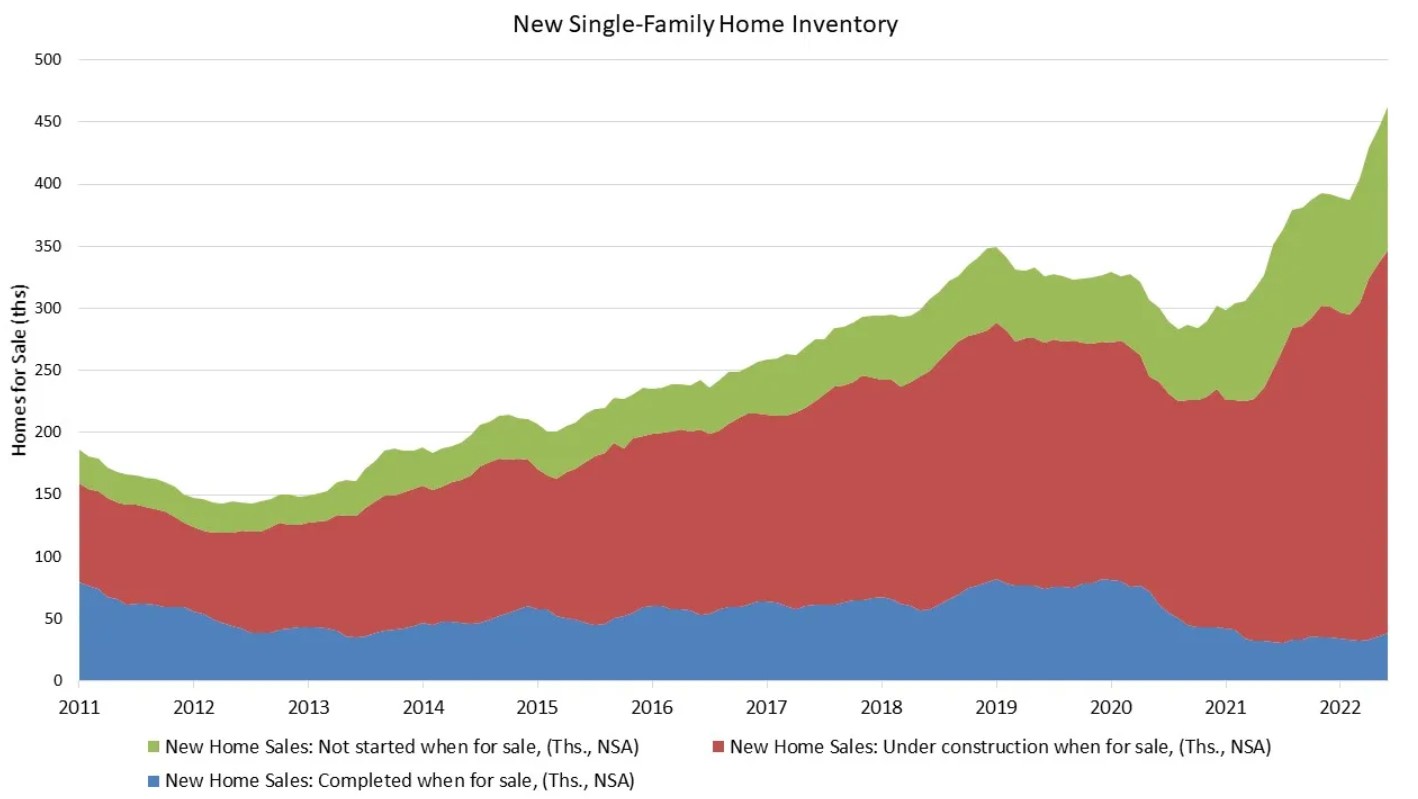

Sales-adjusted inventory levels are at an elevated 9.3 months’ supply in June. The count of completed, ready-to-occupy new homes is just 39,000 homes nationwide. Moreover, sales are increasingly coming from homes that have not started construction, with that count up 25.1% year-over-year, not seasonally adjusted (NSA). The median sales price dipped to $402,400 in June, down 9.5% compared to May, but up 7.4% compared to a year ago.

Nationally, on a year-to-date basis, new home sales are down 13.4% for the first half of 2022. Regionally, on a year-to-date basis, new home sales fell in all four regions, down 12.1% in the Northeast, 24.8% in the Midwest, 12.6% in the South and 9.6% in the West.