Charts: Multifamily Construction Continues Evolution

Originally Published by: NAHB — October 4, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

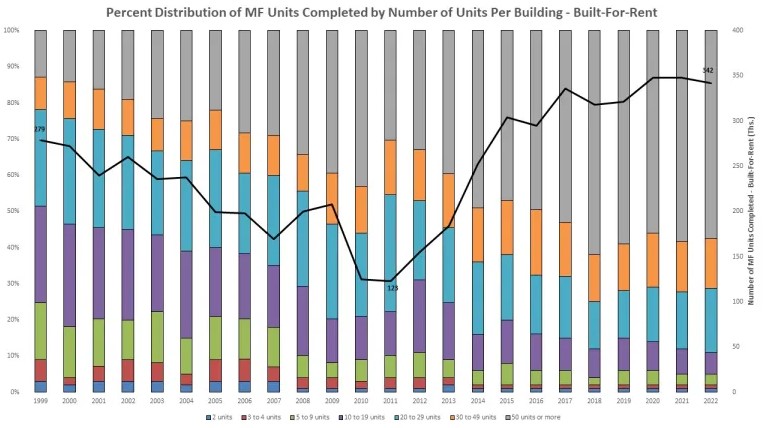

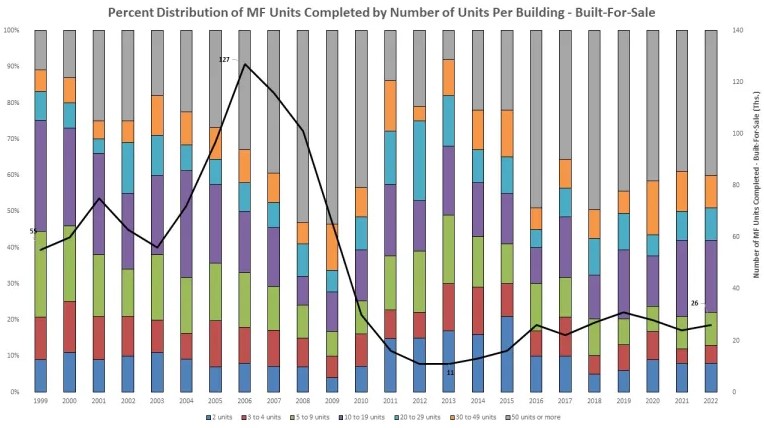

NAHB Analysis of the Census Bureau’s Characteristics of Units in New Multifamily Buildings Completed finds that 93% of the 368,000 multifamily units completed in 2022 were built-for-rent while the remaining 7% were built-for-sale. The share of new multifamily units that are built-for-sale has remained below 10% since 2011 when the share was 12%. 2011 was also the same year that the number of multifamily units completed bottomed out at 138,000 before increasing over the next six years. Since 2011, the share of multifamily units built-for-rent has averaged 93%. This is higher than the previous 12-year period from 1999-2010 where the share of new multifamily units completed built-for-rent averaged only 74% of new units. The share of completed multifamily units built-for-rent was at its minimum in 2007 at 60%.

While the number of multifamily units being completed is at a level higher than pre-Great Recession completions, the type of building where units are located is vastly different than past construction. In 2022, 58% of completed multifamily units built-for-rent were in buildings that had 50 units or more. This has been a trend since 2017 where over 50% of completed multifamily units built-for-rent each year have been in buildings with 50 or more units. The percentage of built-for-rent units completed that were in buildings with 50 or more units in 1999 was just a mere 13%. Buildings with between 30 to 49 units was the only other type to increase its percentage of completed built-for-rent units from 9% of all units in 1999 to 14% in 2022. The largest decrease in the percentage of completed built-for-rent units between 1999-2022 was in buildings with 10 to 19 units, which saw its percentage drop 21 percentage points from 27% in 1999 to 6% in 2022. Buildings with under 10 units completed 25% of built-for-rent units in 1999, by 2022 this was only 5%. There is a clear trend that multifamily built-for-rent has been increasingly focused on high-density over the past 20-years while the medium to light density has been reduced greatly. The missing middle of the multifamily market continues to be an issue as medium to light density buildings are not being built at the same rate as in previous decades.

Built-for-sale units vary from the built-for-rent units by the type of building in which they are located. 40% of built-for-sale units were completed in buildings with 50 or more units in 2022, matching the built-for-rent market as the largest share of multifamily completions. Buildings with 30 to 49 units and 20 to 29 units both had 9% of all built-for-sale units. 20% of completions, the second highest percentage share of built-for-sale units, were in buildings with 10 to 19 units. Unlike the built-for-rent market, 22% of built-for-sale units were built in buildings with less than 10 units.

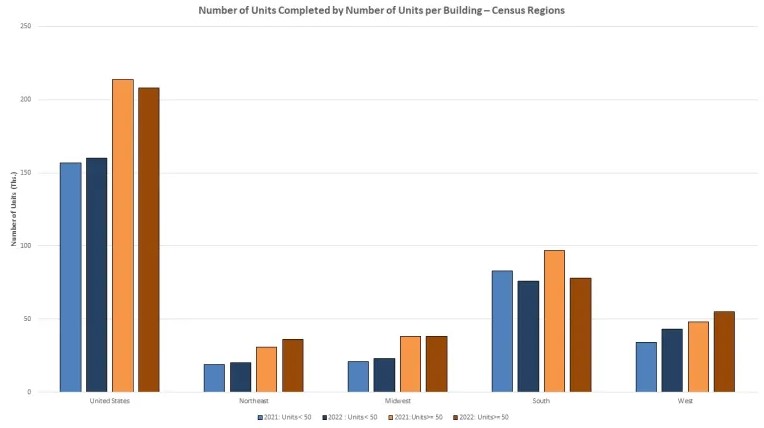

Across the four Census Regions, a majority multifamily units completed in 2022 were in buildings with 50 or more units. This is consistent with 2021 completions by region. The Northeast region saw an increase in completions in buildings with less than 50 units from 19,000 in 2021 to 20,000; buildings with 50+ units also increased from 31,000 to 36,000. In the Midwest region multifamily buildings with less than 50 units increased the number of units completed from 21,000 to 23,000 but saw no change in the number of units completed in buildings with at least 50 units at 38,000. The South region was the only among the four to see a decrease in the number of units completed in the region with the number of units completed in buildings with less than 50 units falling from 83,000 to 76,000 and the number of units completed in buildings with 50 or more units falling from 97,000 to 78,000. The West region had the largest increase in the number of units completed for both types of buildings with the number of units completed in buildings with less than 50 units increasing from 34,000 in 2021 to 43,000 in 2022 and the number of units completed in buildings with 50 or more units increasing from 48,000 to 55,000.