Construction Industry Braces for One-Two Punch: Tariffs and Deportations

Originally Published by: Wall Street Journal — December 3, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Two decades ago, this booming suburb on the northeastern edge of Dallas was a small town accessed by only a two-lane highway. Now, 200,000 people fill its sprawling subdivisions, with new construction everywhere.

McKinney, like the country’s other fastest-growing cities, is a town built by imported labor and home to an industry hooked on imported steel and lumber.

That leaves the construction industry particularly vulnerable to President-elect Donald Trump’s vow to deport millions of undocumented immigrants, and his threats to introduce new tariffs on Mexico and Canada.

Many economists and builders say the loss of the immigrant workforce would drive up the cost of wages for some positions and leave others unfilled.

“We will absolutely have a labor shortage,” said George Fuller, a longtime Texas developer who is also mayor of McKinney. “Whether you want to acknowledge it or not, these industries depend on immigrant labor.”

The McKinney mayor, who describes himself as a Reagan Republican, said he would prefer all workers to be documented and would like to see more materials produced in the U.S. But he said he thought a heavy-handed approach of deportations and tariffs would be a painful way to advance those goals.

“The short-term impact, I don’t want to say devastating, but it would be a significant impact,” he said.

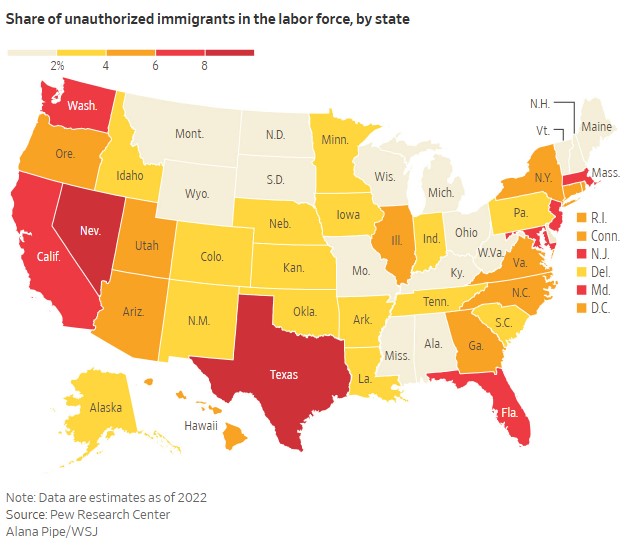

In Texas, California, New Jersey and the District of Columbia, immigrants make up more than half of construction trade workers, according to Riordan Frost, a senior research analyst at the Harvard Joint Center for Housing Studies. Undocumented workers make up an estimated 13% of the construction industry—more than twice that of the overall workforce, according to a recent estimate from Pew Research Center.

Trump, a former real-estate developer himself, has said he would support the construction industry by easing regulations and allowing more building on federal land. But many economists and builders say the loss of the immigrant workforce would drive up the cost of wages for some positions and leave others unfilled.

George Fuller, mayor of McKinney, Texas

On top of that, the president-elect’s proposed tariffs of 25% on Canada and Mexico could increase the cost of construction materials.

Overall, about 7.3% of home-building materials are imported, according to the National Association of Home Builders. Softwood lumber, used to frame buildings, often comes from Canada, which now has a tariff of 14.54%. The U.S. is also the world’s top importer of the crucial housing materials iron and steel. About a quarter of America’s $43 billion in imported iron and steel came from Canada as of 2022, according to the Observatory of Economic Complexity.

Another key home-builder import from both Mexico and Canada is cement. The U.S. imported $512 million of cement from Canada and $254 million from Mexico in 2022. Gypsum, which is used to make drywall, is also imported from both countries and has already jumped nearly 50% in price since 2020, NAHB said.

Asked about the consequences of tariffs and deportations for the construction industry, a spokeswoman for Trump’s transition team said the incoming president “will work quickly to fix and restore” the economy by “re-shoring American jobs, lowering inflation, raising real wages, lowering taxes, cutting regulations, and unshackling American energy.”

Many industry players are upbeat about some parts of Trump’s policy package.

Michael Bellaman, president and chief executive of Associated Builders and Contractors, which endorsed Trump, said “enthusiasm is very high” because of the prospect of deregulation under the president-elect. Federal and local government regulations add more than $90,000 to the cost of a new home, according to NAHB.

Materials used to make rebar and drywall are key imports from Mexico and Canada.

“The incoming administration is obviously pro-worker, pro-growth and pro-business,” Bellaman said.

Still, home builders are already starting to brace for deportation and trade policies. Industry lobbyists have warned the Trump transition team that the policies could have a chilling effect on builders and the overall market, a person familiar with the matter said.

Builders said they would pass at least some of the increased costs on to home buyers, when prices are already near record highs and mortgage rates are on the rise again.

“It would just add to the price pressure of housing at a time when affordability is already very stretched,” said Eric Finnigan, vice president of demographics research at John Burns Research & Consulting.

After more than 300,000 undocumented immigrants were deported between 2008 and 2013, Americans didn’t replace all the construction positions they previously held, according to a study by the universities of Utah and Wisconsin this year. It found the deportations caused a resulting loss of about a year’s worth of construction for the average county and raised new home prices roughly 20%.

Construction companies have struggled with major worker shortages since the 2008-09 financial crisis, which left the industry reeling with steep job losses. Many U.S.-born workers pivoted to opportunities that were higher-paying, less physically demanding or both.

Home builders fear that mass deportations and new tariffs will have a significant impact on the housing market.

Builders said that even during times of high unemployment, most native-born Americans are unwilling to take the industry’s most physically grueling jobs, especially in Texas, where framing or laying pipe often occurs in temperatures over 100 degrees Fahrenheit.

Since 2022, some 130,000 newly arrived immigrants have joined the construction industry, pushing the number of foreign-born construction workers to a record, according to the NAHB.

José Ortega has been an undocumented construction worker in North Texas for 12 years. A grandfather from Guatemala, he moved north to find work to support his family. Now, he and his son work side-by-side, framing houses. Ortega also serves as a pastor of a nearby church. Ortega said he would keep working and hopes not to be affected by deportations. He said he doesn’t know why anyone would want to deport him, since he works hard and stays out of trouble.

Even with the surge in migration, roughly half of builders reported shortages earlier this year for directly employed workers and for subcontractors, according to the association’s survey of electricians, roofers, plumbers, painters and businesses in several other trades.

Builders and subcontractors in Texas said they suspect the majority of people working on their sites are undocumented. Most home builders make sure their direct employees have legal status and otherwise rely on subcontractors, who often hire individuals as independent contractors.

One North Texas remodeling subcontractor, who declined to be named to avoid his business being targeted, estimated that of the 40 to 60 men he frequently hires for jobs, some 90% are undocumented—including likely everyone doing framing, roofing and concrete, he said. He has had to turn down roofing jobs on military bases because he knows no roofers with the necessary paperwork that military jobs require.

Even when employers are diligent in checking their workers through the government’s E-Verify site, many of them may pass through a fake identification number.

Mike Forsum of Landsea Homes

Stan Marek, CEO of his family’s Houston-based interior contracting company, recalled his first federal immigration audit some two decades ago, when auditors found dozens of his workers whose names didn’t match their identification. He was forced to fire highly valued employees, he said. But they weren’t deported. Instead, they went to work for his competitors. A few now run their own Texas construction businesses, he said.

The experience led Marek to become an activist to change immigration laws, co-founding the advocacy group Texans for Sensible Immigration Policy. The group supports finding a way for 11 million undocumented immigrants to earn legal status if, among other things, they can pass criminal background checks and learn English.

Construction-industry leaders, he said, are “putting their heads down and hoping like hell it doesn’t happen. But they’re starting to think they need to speak out, like me.”

Other builders are focused on figuring out how tariffs might affect them. Mike Forsum, president of Dallas-based home builder Landsea Homes, surveyed dozens of homes in various stages of construction at a subdivision site 25 miles east of Dallas. He pointed out features he said Texans like: stone exteriors, formal dining rooms and central staircases. The stone is local, but Forsum’s company imports nearly all fixtures and electrical components from other countries.

A construction crew at a building site in McKinney, Texas, last month.

Forsum is keeping a close eye on how proposed tariffs could roil a supply chain that just recently normalized after the turmoil of the pandemic.

Landsea has started an internal assessment of how much the tariffs could increase its home prices.

“It’s not lost on us, the rhetoric around tariffs,” Forsum said. “We’re doing our best to stay in front of it.”