Home Builders Launch New Multifamily Index

Originally Published by: NAHB — May 18, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

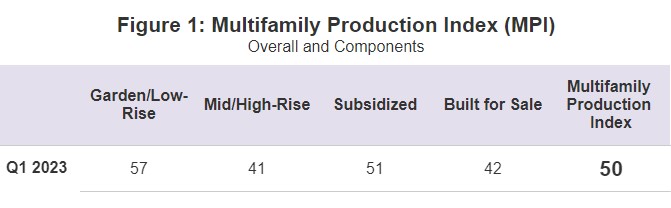

The National Association of Home Builders (NAHB) redesigned its Multifamily Market Survey (MMS) in the first quarter of 2023 to make it easier to interpret and more similar to the NAHB/Wells Fargo Housing Market Index for single-family housing. The MMS produces two separate indices. The Multifamily Production Index (MPI) had a reading of 50 for the first quarter while the Multifamily Occupancy Index (MOI) reading was 82.

The MPI measures builder and developer sentiment about current production conditions in the apartment and condo market on a scale of 0 to 100. The index and all its components are scaled so that a number above 50 indicates that more respondents report conditions are good than report conditions are poor.

The MPI measures builder and developer sentiment about current production conditions in the apartment and condo market on a scale of 0 to 100. The index and all its components are scaled so that a number above 50 indicates that more respondents report conditions are good than report conditions are poor.

The new MPI is a weighted average of four key market segments: three in the built-for-rent market (garden/low-rise, mid/high-rise and subsidized) and the built-for-sale (or condominium) market. The survey asks multifamily builders to rate the current conditions as “good,” “fair, or “poor” for multifamily starts in markets where they are active. For the first quarter, the component measuring garden/low-rise units had a reading of 57, the component measuring mid/high-rise units had a reading of 41, the component measuring subsidized units had a reading of 51 and the component measuring built-for-sale units had a reading of 42.

The MOI measures the multifamily housing industry's perception of occupancies in existing apartments on a scale of 0 to 100. The index and all its components are scaled so that a number above 50 indicates more respondents report that occupancy is good than report it is poor.

The new MOI is a weighted average of three built-for-rent market segments (garden/low-rise, mid/high-rise and subsidized). The survey asks multifamily builders to rate the current conditions for occupancy of existing rental apartments in markets where they are active as “good,” “fair” or “poor.” For the first quarter, the component measuring garden/low-rise units had a reading of 84, the component measuring mid/high-rise units had a reading of 74 and the component measuring subsidized units had a reading of 87.

Because the previous version of the MMS series can no longer be used to compare with this quarter’s results, the redesigned tool asked builders and developers to compare current market conditions in their areas to three months earlier, using a “better,” “about the same” or “worse” scale. Sixty-seven percent of respondents said the market is “about the same” as it was three months earlier.

“Garden/low-rise units had the strongest production index of all four sectors covered in the survey, while subsidized units had the strongest occupancy index,” said Lance Swank, president and co-owner of Sterling Group, Inc. in Mishawaka, Ind., and chairman of NAHB’s Multifamily Council. “However, higher interest rates and increased construction costs are negatively impacting projects in certain parts of the country.”

“NAHB’s current forecast has multifamily starts declining by more than 10% per year in 2023 and 2024,” said NAHB Chief Economist Robert Dietz. “Commentary from multifamily builders indicates that it has become more difficult to obtain loans for multifamily development as a result of tightening financial conditions due to actions of the Federal Reserve, which reduce future apartment construction.”

For additional information on the MMS, visit nahb.org/mms.

For more information on the NAHB Multifamily program, please visit NAHB Multifamily.