Multifamily Demand Softened Slightly in Q4 2022

Originally Published by: NAHB — May 25, 2023

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Data from the Census Bureau’s latest Survey of Market Absorptions of New Multifamily Units (SOMA) indicates that multifamily market demand has softened as the percentage of apartments absorbed within the first 3 months of completion fell to 59.0% after six consecutive quarters of above 60.0% percent absorption.

The absorption rate of unfurnished, unsubsidized apartments (the share rented out in the first three months following completion) fell two percentage points to 59.0% in the fourth quarter of 2022. The number of completions was down from the third quarter of 2022, from 85,830 to 82,190, while completions were up 18.0% from one year ago.

The median asking rent for apartments increased from $1,821 in the fourth quarter of 2021 to $1,863 in the fourth quarter of 2022, a 2.3% increase over the year. This is the eighth consecutive quarter with a year-over-year increase in the median asking rent price.

The condominium absorption rate (the share purchased in the first three months following completion) increased from the third quarter of 2022 by one percentage points to 78.0% while condominium completions decreased by 10.3% on a year-over-year basis from 5,760 in the fourth quarter of 2021 to 5,165 in the fourth quarter of 2022.

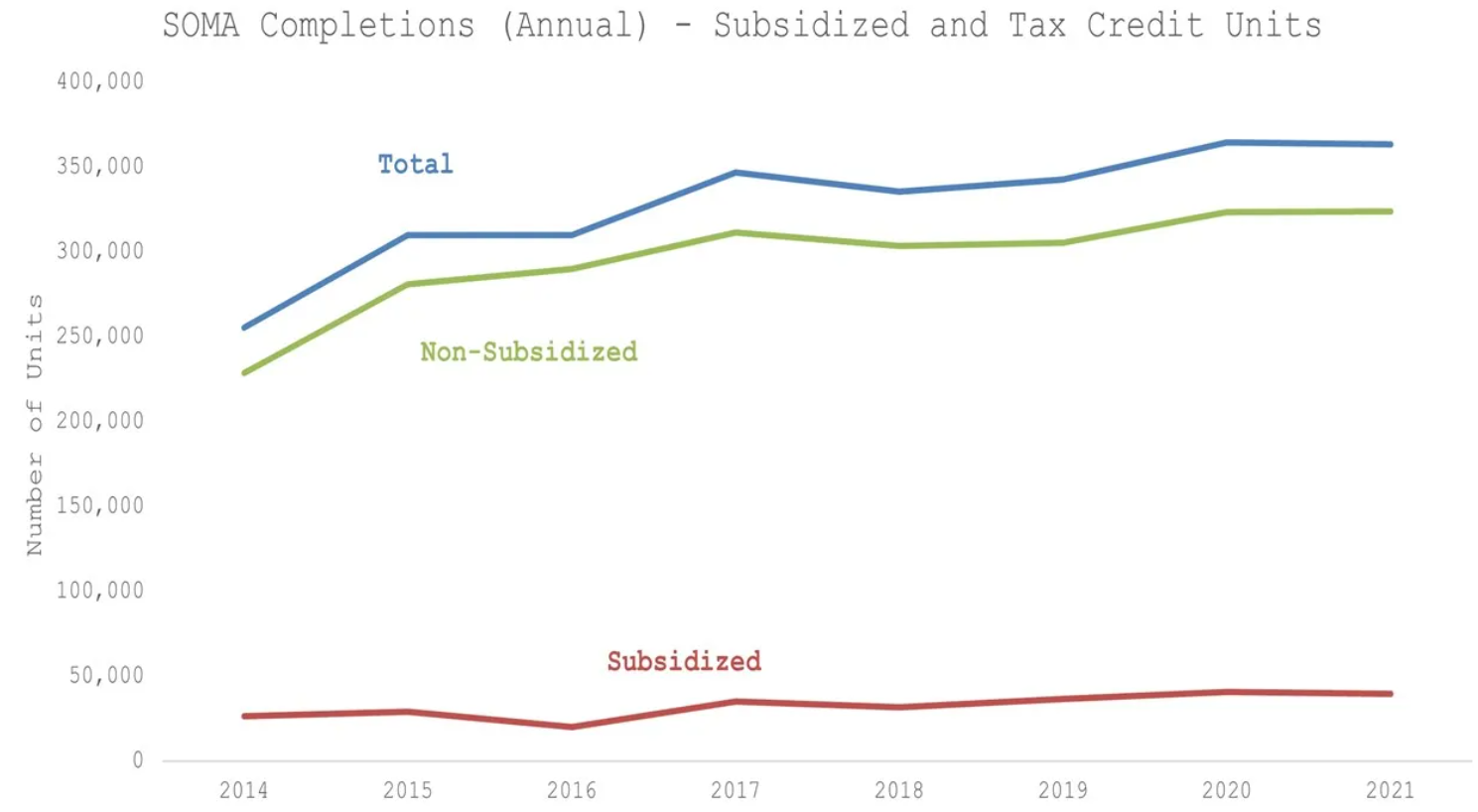

The annual results for SOMA were also released for 2021. These results show that subsidized units make up a minority of all multifamily units completed. Total units completed in 2021 was at 363,700 units, with 323,900 of those units being unsubsidized and 39,760 units receiving subsidization or tax credit for completion. The share of units completed receiving a subsidy averages 9.9% per year between 2014-2021.

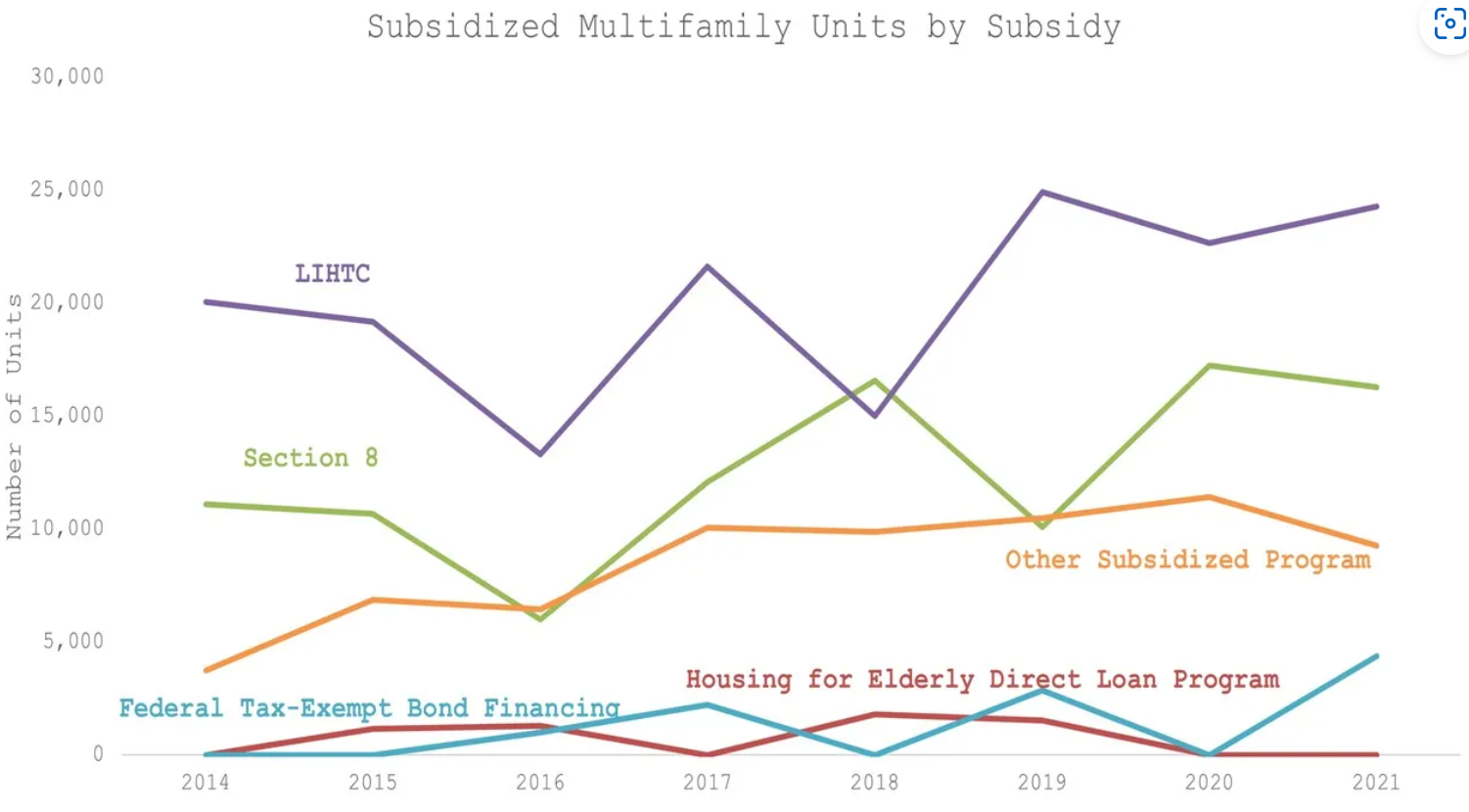

Breaking the subsidized units out by the type of assistance, the data shows that the Low Income Housing Tax Credit (LIHTC) was the most often used program in 2021. The LIHTC assistance accounted for 24,280 units completed in 2021, slightly below the peak level of 24,930 in 2020 (note this estimate likely understates the full scope of the LIHTC program given the full uses of the credit). The section 8 program was used to complete 16,300 units in 2021 while other subsidized programs was used for 9,258 units. Federal Tax-Exempt Bond Financing subsidized 4,388 units in 2021, the highest number of units in the SOMA data for a given year for this type of assistance. This likely reflects the fixed 4% credit. The Housing for Elderly Direct Loan Program estimates did not meet publication standards in 2021.

In 2021, the South Region completed the most multifamily units (177,500) and the most subsidized multifamily units (14,950). Despite this, the South Region had the second lowest share of subsidized units of the four regions with 8.4% of completed units being subsidized. The West region had the highest share subsidized units with 18.2% of the 80,150 total units completed being subsidized. The share of subsidized units in the Northeast fell 11.9 percentage points from 18.9% to 7.0% between 2020 and 2021, dropping from the highest share in 2020 to the lowest in 2021. The Midwest had the second highest share of subsidized units in 2021 at 11.8%.